The North East Isn’t Just Rising – It’s Being Rewired

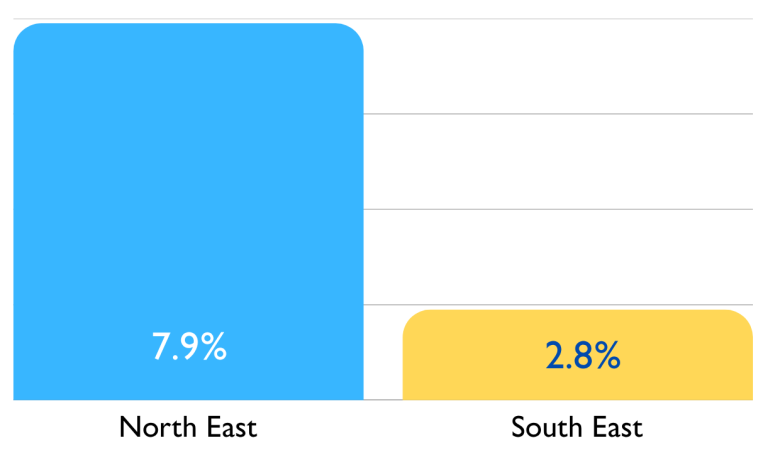

In 2025, the North East posted the strongest property performance in England. House prices rose 7.9% in the twelve months to July 2025, while the national average rose only 2.8% (Office for National Statistics). Rents climbed nearly 10%, underscoring a market driven by demand and underpinned by long-term structural growth. This is not luck – it’s rebalancing.

While much of the UK market has paused or plateaued, the North East has reignited momentum. Regional growth is now significantly outpacing the rest of England, placing the area firmly among the most compelling long-term property plays.

House Price Growth Comparison (July 2025):

These figures confirm what many investors already sense: undervalued markets with strong fundamentals offer higher potential returns. In regions like the North East, affordability meets opportunity.

Rebalancing the Market – and the Story Investors Are Buying

Investors today aren’t just buying properties – they’re buying into a story of rebalancing. They’re capitalising on undervaluation, high rental demand, and the security of long-term income. The North East has become the frontier for disciplined growth, where risk is moderated by affordability and upside is supported by infrastructure and innovation, not speculation.

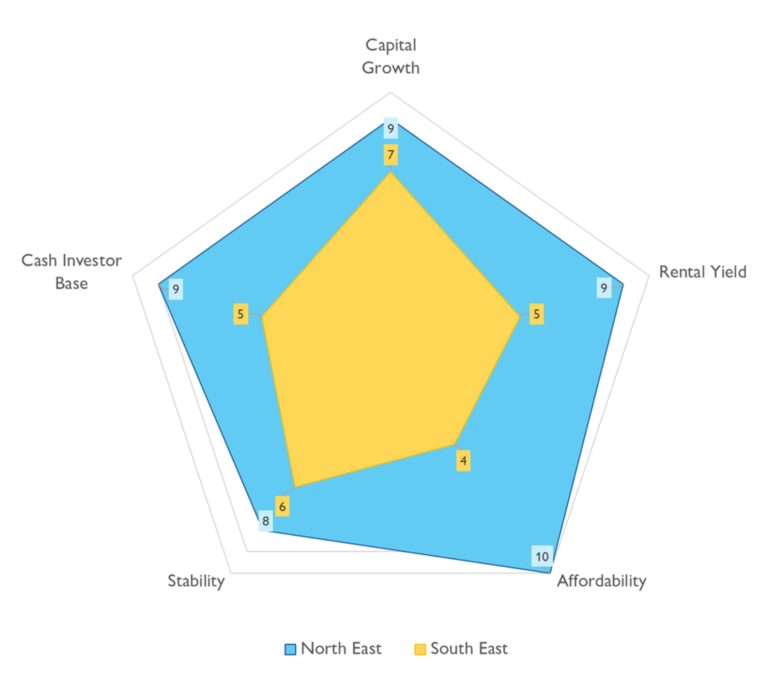

The chart below grades 5 the key metrics for investment value from 0 to 10, comparing the North East with the South East.

Rental Yields Aren’t Just Higher – They’re Also Increasing at a Greater Rate Than Anywhere Else

In the 12 months to May 2025, private rents in the North East rose 9.7%, the highest in England. By July, rent inflation remained strong at 8.9% (ONS). This sustained rental growth reflects high demand from both buyers and tenants – a sign of deep market strength and confidence in regional housing.

Why the North East Outpaces the Rest – Infrastructure, Investment and Momentum

The real story behind the North East’s performance isn’t just its recent numbers – it’s the foundation being built beneath them. Across the region, billions are being channelled into transformative infrastructure, transport, and innovation projects that will reshape accessibility and employment.

Hefty Transport Funding

The region is set to receive £19.8 billion for transport improvements (Highways Magazine), linking major cities with new stations, reopened rail lines, and upgraded public transport. £1.85 billion is being directed into roads, metro upgrades, EV charging, and walking and cycling routes – ensuring that progress is as sustainable as it is significant.

The Tyne & Wear Metro expansion, including new stations like Washington North & South, is part of a longer-term vision to connect communities and employment hubs.

In Sunderland, the Keel Crossing, a 260-metre pedestrian and cycle bridge will unlock over 30 hectares of riverside development land.

Each project reduces travel friction, widens commuter catchments, and raises land values along newly connected corridors. Together, they form a powerful platform for growth that rewards foresightful investors.

Institutional Investment and the AI Growth Zone

Beyond infrastructure, institutional capital is anchoring the region’s trajectory. The new AI Growth Zone, backed by UK–US collaboration, is set to create 5,000 jobs and attract up to £30 billion in private investment. Meanwhile, Blackstone’s planned hyperscale data centre campus will inject billions and position the region as a national digital hub. (Pride in Place Programme / GOV.UK)

County Durham: The Beating Heart of Regeneration

County Durham captures much of what makes the North East’s resurgence real. It combines affordability, ambition, and infrastructure-driven upside. Average house prices stood at around £140,000 in July 2025 – up 10.4% year-on-year, with average private rents at £612 per month, up 8.7% (Your Money) This balance of affordability and growth gives investors breathing space and long-term confidence.

Durham’s Aykley Heads Innovation District is reshaping the city’s employment base, bringing together business, research, and government in a 60-hectare site. Durham University’s research ecosystem fuels a steady stream of talent and tenants, while infrastructure upgrades, including future connections to the Leamside Line, will only deepen its regional integration.

In Bishop Auckland, the £200 million Auckland Project is transforming the town through culture-led regeneration. With over 1.5 million annual visitors expected by 2029, it’s a model for how heritage and investment can reshape a town’s future and housing market.

Meanwhile, NETPark in Sedgefield continues to anchor science and technology growth. Its £100 million Phase 3 expansion adds nearly 300,000 sq. ft of new space, deepening the county’s ties to high-value sectors like aerospace and advanced manufacturing. (NorthEastTechnologyPark.com).

Infrastructure in Motion

This isn’t theoretical growth. It’s happening in real time – in bridges, metros, and innovation hubs that create the physical backbone of progress. Over £19 billion is being spent to connect cities, expand transit, and modernise how people and goods move through the region. That kind of transformation doesn’t just lift property values – it rewires economic potential.

Investors in the North East aren’t simply buying bricks and mortar. They’re buying into an evolving landscape that’s being reshaped by design, driven by long-term policy alignment and the steady flow of institutional capital.

Find UK Property – Aligned with the North East’s Momentum

Billy Rawson, Property Consultant at Find UK Property comments on how they are uniquely positioned to offer a hands-free gateway for investors to the North East region:

“We understand this evolution because we’re part of it. Our North East portfolio captures the essence of this transformation – affordable homes, strong yields, and dependable growth supported by genuine infrastructure momentum.

With net rental returns averaging 7%, our properties provide passive investors with predictable income and long-term capital upside. In a market where value is shifting north, we’re perfectly positioned to help investors benefit from the next phase of regional rebalancing.”

The North East isn’t just rising – it’s being rewired. And through Find UK Property, investors can be part of that story – one built on fundamentals, foresight, and financial stability.

5 responses