September 2025 Property Prices – The North is Up 5%

September 2025 delivered further optimism for the UK housing market. The latest data from Nationwide and Savills show that prices are once again climbing, especially in the north where annual growth is over 5%.

Regional Focus: The North Is Leading The Market

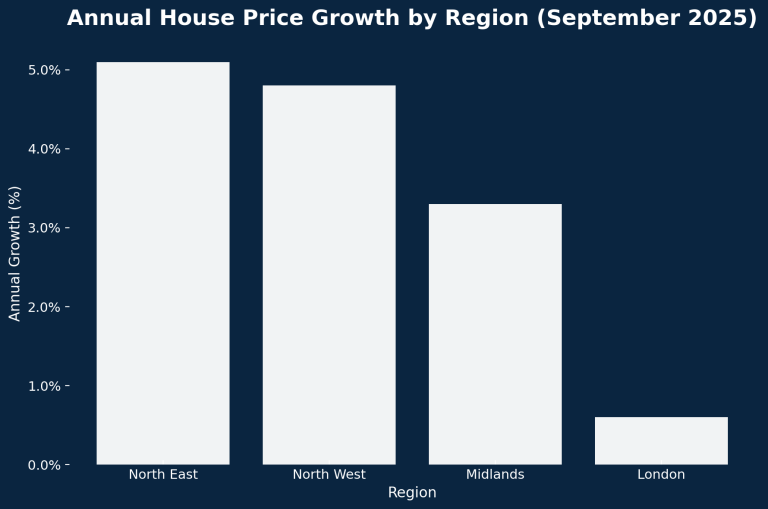

While the national increase is modest on the surface, with overall annual growth of just 2.2% – the regional picture is of greater interest to investors, landlords and homebuyers alike.

Regional analysis reveals that the North continues to outperform the South. The North of England recorded annual growth of 5.1%, and the Midlands approximately 3.3%. By contrast, London and the South East posted gains of less than 1% (The Guardian; What Mortgage).

What’s fuelling the Northern Fire?

Savills notes that affordability and employment resilience are fuelling this divide, with northern regions offering a more accessible route for both investors and first-time buyers (Savills).

The North East and North West have benefited particularly from infrastructure investment and strong rental markets. This supports both purchase activity and rental yields, reinforcing the long-term fundamentals of northern property markets.

Investors working with Find UK Property have capitalised on this regional shift, securing high-quality, fully managed buy-to-let properties in areas such as Lancashire and County Durham – locations where demand remains strong and entry prices are far below national averages.

The Monthly View – September vs. August

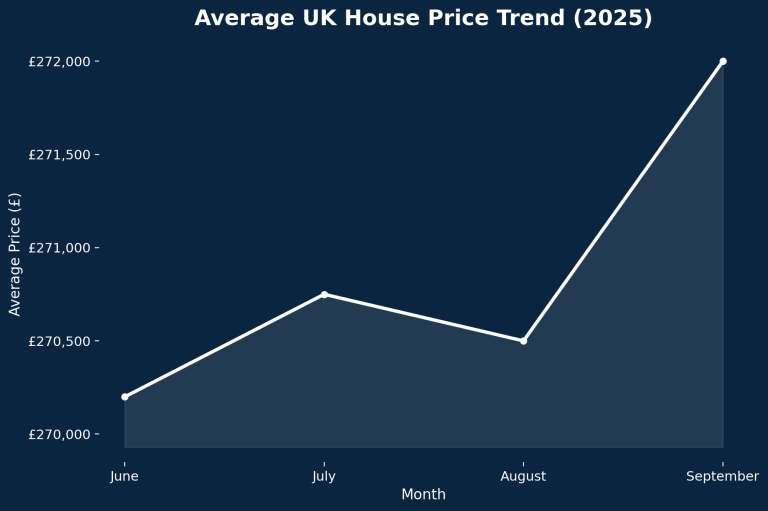

Nationally, property values rose across the board by 0.5% between August and September. The Guardian described the market as returning to ‘broad stability’, highlighting that buyer confidence has improved and activity levels are getting back to normal (The Guardian).

National Picture: Growth Returns

The average UK house now stands at £271,995, representing the highest level so far in 2025 (Nationwide, 2025). Industry data shows that listing volumes are up by nearly 4% month on month, a signal that sellers are regaining confidence.

This period of stability suggests the UK market is responding well to The Bank of England’s cautious policy on interest rates, which have been dropping slowly.

For those seeking reliable insights and hands-off property investments, Find UK Property continues to guide buyers towards affordable, high-yield houses across the country, particularly in the most resilient regional markets.

We are seeing consistent demand from investors who previously focused on the South, but are now choosing areas such as Middlesbrough, Hartlepool and Durham. Average net yields of around 7-10%, combined with steady capital growth make the North East an enticing option for a long-term portfolio.

Joshua Walters, Senior Consultant at Find UK Property

Find UK Property reports a notable rise in investor interest from overseas buyers as well, particularly from clients seeking stable rental income and UK-based asset security. Their fully managed service allows investors to purchase, let, and maintain properties remotely – an attractive option amid ongoing global uncertainty.

Expert Insight

Joshua Walters, Senior Sales Consultant at Find UK Property, reflected on the shift in investor focus:

“Investor enquiries for North East properties have risen by more than 30% in 2025. We are seeing consistent demand from investors who previously focused on the South, but are now choosing areas such as Middlesbrough, Hartlepool and Durham. Average net yields of around 7-10%, combined with steady capital growth make the North East an enticing option for a long-term portfolio.”

Walters’ observation aligns with wider market behaviour. Investors are diversifying their portfolios northward, seeking both yield and affordability. The cost of northern property compared to the south allows for diversification – more properties for the same amount of money, with greater rental returns.

For those considering entering the market, Find UK Property offers a proven track record and turnkey investment packages which are ideal for both first-time and international investors.

In Summary

Looking forward, industry forecasts point to continued and steady growth. Softening interest rates and regional investment will likely sustain this balance. For investors, the message is one of positioning – pick the regions where your money will work the hardest.

Key Takeaways

- The UK property market regained momentum in September 2025, with northern regions seeing an uplift of around 5% annual growth

- Northern and midland regions continue to outperform southern areas, offering stronger growth potential and higher yields.

- Investor activity is shifting northward, as affordability and investment in infrastructure improve market fundamentals.

- The outlook for 2026 remains positive but measured, with sustainable rather than speculative growth expected.

- Find UK Property remains a key partner for investors looking to secure passive income from high-yield, fully managed properties in the UK’s most promising regions.