Invest For Less

2-Step Investment Solution

Get On The Property Investment Ladder

Spread The

Cost Over

3 years

Pay in 2 affordable steps.

1. £39,999 up front

2. The rest in 3 years

Build Discount

at 8.5%

Per Year

Total Discount of £10,200 deducted from the final property price.

Final Cost

Fixed At

Today's Price

Who knows how much property prices will increase by in 3 years?

Receive

Interim Property

As Security

Your initial payment gets you a 'stepping stone' property as security.

2 Simple Steps Towards A

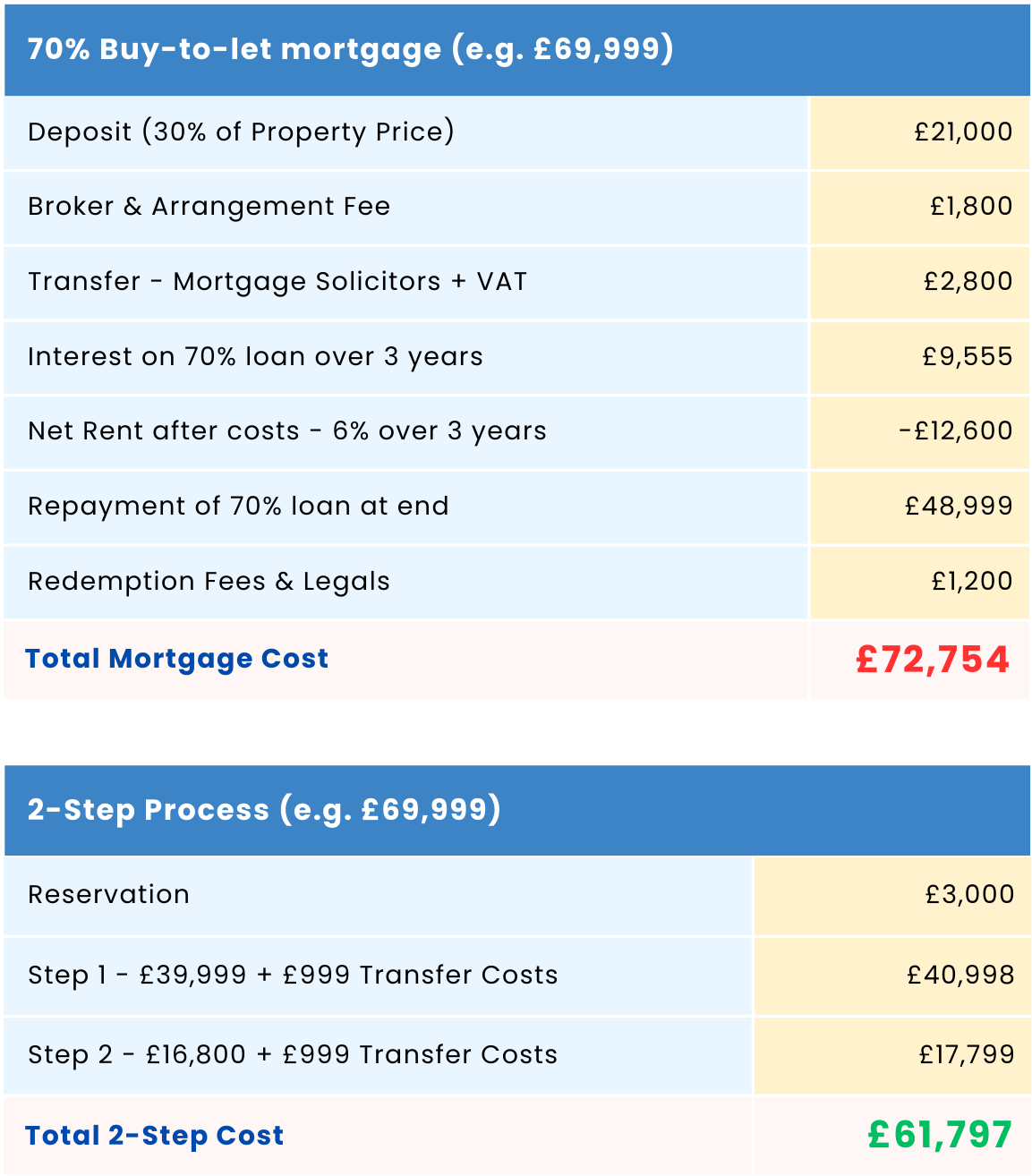

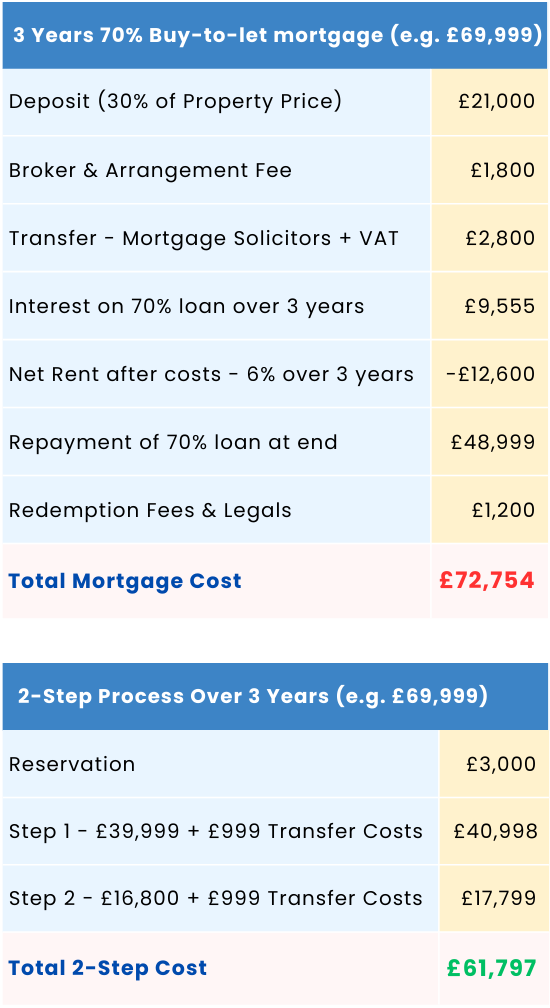

If you are overseas or already own UK property, then stamp duty may be payable at Step 2 in the above example. There are also £999 transfer costs at each step.

No other costs.

If you are overseas or already own UK property, then stamp duty may be payable at Step 2 in the above example. There are also £999 transfer costs at each step.

No other costs.

- Buy a Small 1-Bed interim investment property, with full ownership for just £39,999.

- This is a stepping stone giving you a benefit of £10,200 over 3 years acting as security for your initial payment

- This works out as a 8.5% net return per year, earned as a discount on your final, full rental property.

- After 3 years, you upgrade to your desired final property, H1 to H8 depending on your budget.

- The final payment is £10,200 less than today's price due to the discount you have built up.

- You start to earn income at 6% net rent or 7% if you opt for a Flexi-Furnished property.

RESERVATION COSTS

By making a £3,000 reservation payment for the 2-Step Solution, your property prices are fixed and do not increase over time for the next 4 years. The £3,000 reservation comes off your final property payment and is not lost.

Future Property Prices

Fixed In The Present

Reap the benefit as prices normally increase by around £10,000 over such a period

Your price is fixed at the lower level for the whole of the time range.

The offer is limited to one per client.

Interim Properties

Small 1-Bed

£39,999

House Layout

Two small rooms downstairs comprising Lounge and Kitchen with small rear yard. One Bedroom and a Bathroom.

£10,200

Over 3 Years

Interim Property Details

- Freehold You own it outright

- Fully Renovated and Tenanted Compliant and Rented Out

- Typical Value £60k You own it until you decide to upgrade

- Build Discount of £10,200 Off your final property price, instead of receiving rental income (over a period of 3 years)

Pay £3,000 reservation which is included in the final price.

£999 Purchase Cost applies twice – once for each property purchase, at Step 1 and Step 2. This covers solicitor, local searches and admin costs.

We Take Care Of All

Landlord Liabilities

Annual Gas & Electrical Certificates

All Repairs & Tenant Damage

Council Tax & Any Other Bills If Empty

All Other Liabilities

You Remain The Passive Owner

Interim Properties

Small 1-Bed

£39,999

House Layout

Build 8.5% Discount

£10,200

Over 3 Years

Interim Property Details

- Freehold You own it outright.

- Fully Renovated and Tenanted Compliant and Rented Out.

- Typical Value £60k You own it until you decide to upgrade.

- Build Discount of £10,200 Off your final property price, instead of receiving rental income (over a period of 3 years).

Pay £3,000 reservation which is included in the final price.

£999 Purchase Cost applies twice – once for each property purchase, at Step 1 and Step 2. This covers solicitor, local searches and admin costs.

We Take Care Of All

Landlord Liabilities

Annual Gas & Electrical Certificates

All Repairs & Tenant Damage

Council Tax & Any Other Bills If Empty

All Other Liabilities

You Remain The Passive Owner

2-Step Solution

vs Buy-to-Let Mortgages

Why is 2-Step better than a Buy-to-Let mortgage? There’s no interest, a significant discount on your final property price and security from day one with full ownership of an interim property. Why give your money to the bank?

Why Buy-to-Let

Mortgages Don’t Work

No Profit With High Interest Rates

Due to high interest rates, you are unlikely to achieve profit with a buy-to-let mortgage. The interest on the mortgage, the fees and renovation costs, are usually higher than the rental income.

You're Only Paying Off Interest

The whole loan remains outstanding at the end of the mortgage term. You have to pay the full amount to own the property outright, or sell the property to clear the large mortgage balance.

More Risk With No Flexibility

A mortgage puts you in debt and has a complicated approval process. It does not provide the same flexibility as our 2-Step Solution, to choose whatever property you want in 3 years time.

No Guarantees

Or Savings

There are no guarantees with properties purchased on the open market to rent out yourself. Compared to our 2-Step Solution, you can also end up being £10,000 worse off with a buy-to-let mortgage.

Have Questions?

Complete enquiry form and provide ID of owner (passport copy and address). We send you a draft agreement for you to look at, and we arrange a zoom meeting to cover all of your questions. You can also visit us if you wish – although this is not required. Then you can decide if you wish to proceed.

The initial steps after getting agreement and zoom meeting are:-

– Sign agreement and make £3,000 reservation payment to client account. This fixes prices on our range for you for next 4 years.

– Have video meeting with solicitor to verify ID, provide bank statement to show funds, and get any other documents ready

– Agree the interim property – 1 bed house (within 6 weeks of reservation)

– Make step 1 payment (e.g. £39,999 plus £999 transfer costs)

– Get ownership of interim property (including Land Registry Title Documents)

– Later, let us know when you are ready to upgrade to your desired final property (Type H1 to H8 Unfurnished or Flexi-furnished) and make the upgrade (Step 2) payment. You end up owning your desired final property. We take back the interim property.

No. The interim property is like a stepping stone to your desired final property. Whilst you own it, you get security, build up to £10,200 discount over 3 years, and have more time to save. You agree to sell it back to us when you upgrade to your desired final house. (It is part of the process – we can not afford to sell it to you for £39,999 permanently as it is worth more). If you fail to upgrade you have to sell the interim property back to us for what you paid us. This is part of the agreement.

No. If you have more than £70,000 then it is best to buy a property in one step (E.g. H1 or H2 house) using our standard method, and not use the 2-step process. You benefit more.

No. This is the minimum amount you need. On top of this you need £999 total purchase costs for Step 1 of the process and £3,000 reservation payment. Keep saving and get back to us when you have enough funds. Alternatively, join with another friend and contribute 50/50 and own the property jointly. That way you only need to save £20,000 to get on the investment property ladder as joint owner.

The default is that you upgrade after 3 years, but we allow a further 12 months if needed (total 4 years) to help you save money to do the upgrade. The discount does not increase beyond £10,200. Worst case scenario – even if you cancel the deal and do not upgrade to any property after 4 years, you still get your £39,999 back. Your built up discount is preserved for use later by you, your family, or your contacts – against any property in our range.

No. The discount you build up is added to the pot after each whole year. The maximum is 3 years worth. If you upgrade 3 years after completion of interim property you get 10,200 discount.

No. The offer is limited to ONE per client .(Limited to ONE live 2-step deal at any time – so you can get another AFTER completing one). It is really to help clients who do not have enough money to buy a property outright in one step.

No. Whilst you are indeed the owner, you agree to this property remaining rented out to our tenants. You benefit by building discount which over 3 years is £10,200 (= 8.5% of the £39,999 invested price per year). Later, when you upgrade to your desired property you sell this interim property back to us as part of the process.

It is your property and you decide what to do with it. The property is initially rented to us (we rent to our long-term tenants) and you have all of the options available to you:-

-Keep it rented to us and get net rent as per our standard system (6% of property price per year for unfurnished and 7% of property price per year for flexi-furnished). You have no costs and we cover everything

-keep it rented to us and build deal discount at 8% of property price to save and buy another property (as per our DIY deals). This is a great tax efficient way to get another property or build a portfolio over time. Many of our clients who are not yet retired take this option and end up with multiple properties before they retire.

-Give us 6 months notice at any time after the minimum 2.5 years to take full possession of your property and then you can:-

– Use it yourself or for your family

– Rent it to anyone else directly

– Use a letting agent to rent it out

– Sell it to anyone (we can also offer to buy back at the prevailing market price at the time).

In the unlikely event our prices fall between now and step 2, you will get the new lower prices – so you benefit and your final payment will be less. However, the opposite is almost certain – our prices are likely to rise, and you still benefit, because your prices will not rise under this deal, and your final payment will remain same as in the table above.

Trusted Around The World

Here To Help

Speak To An Expert