What Makes

Find UK Property Different

Different To Estate Agents

And The Open Market

With a constantly moving pipeline of newly purchased and renovated stock, what makes our process unique?

Reserve & Select

Facilitated Buying Process

Contractual guarantees on the property itself and the buying process, including searches and titles. Allows you to buy directly and receive Land Registry ownership quickly.

No Mortgages

Property Guarantee

Buy Back Option

Post Purchase Support

Tax filing, wills and services for non-residents. We’re here to help you with every aspect of your UK property investment.

Find UK Property

vs Estate Agent

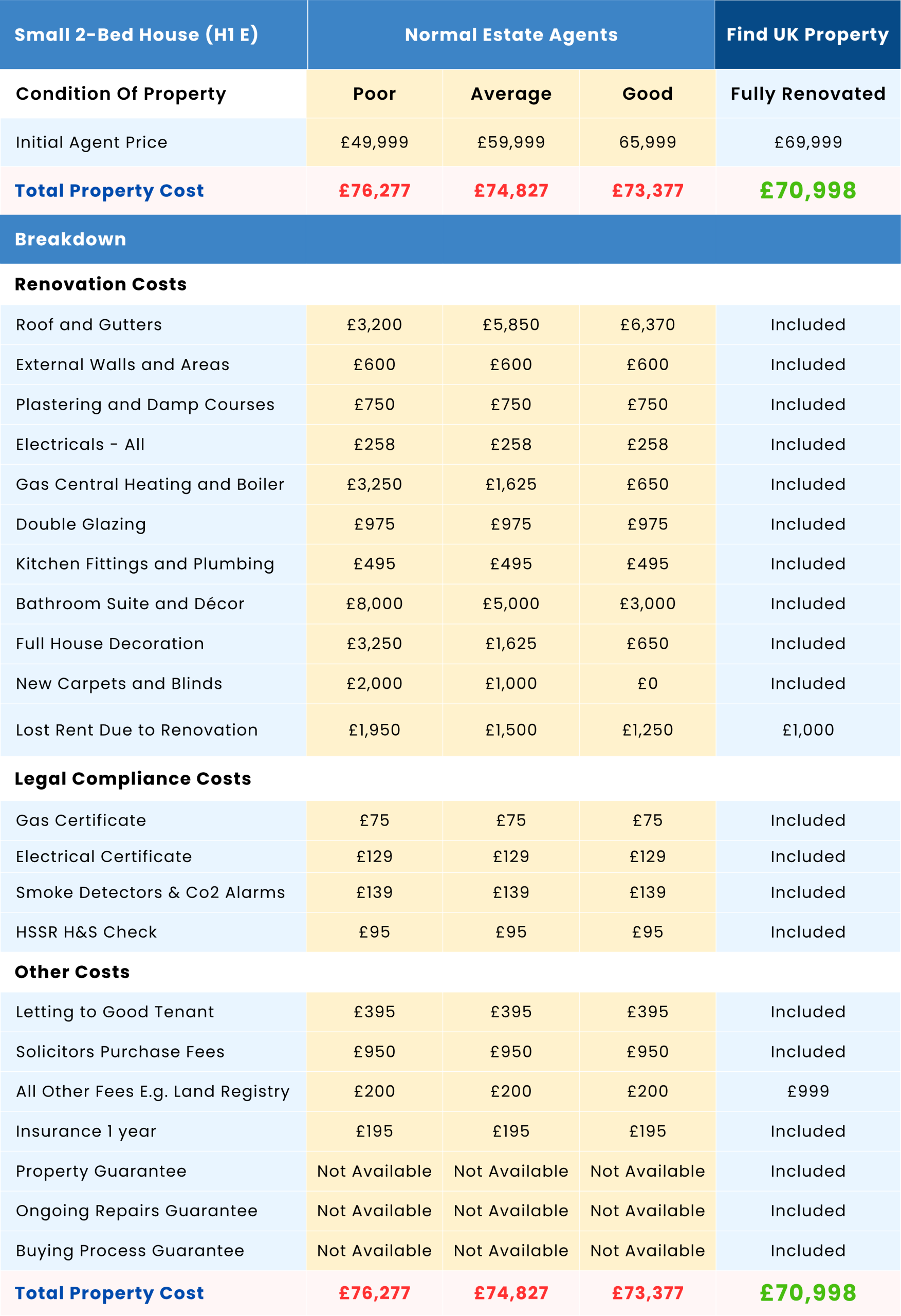

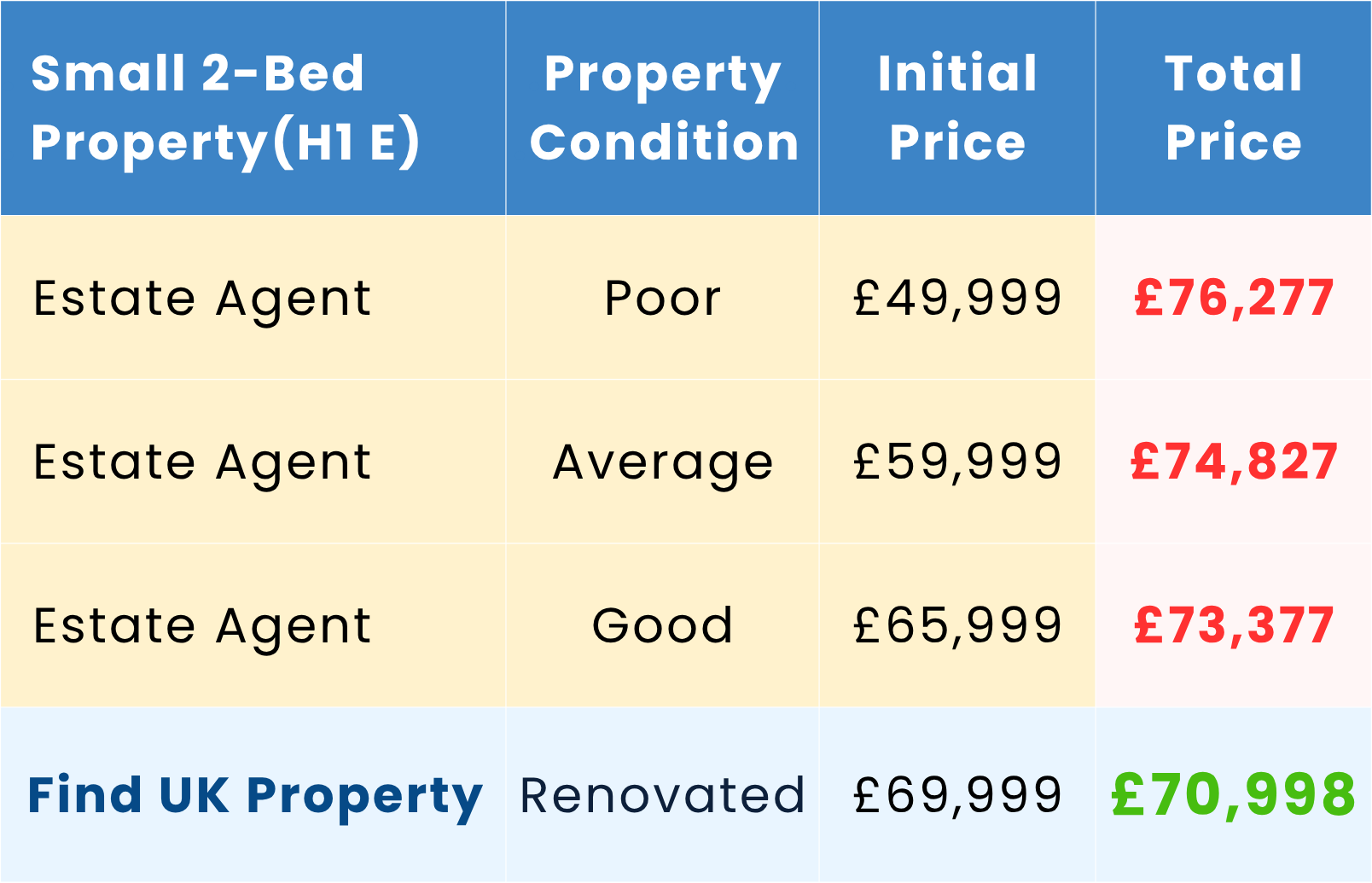

Getting a property up to a decent, rentable standard can often cost more time and money than first-time investors expect.

Buying Comparison with Estate Agents & Open Market

Buying a property below market value means greater renovation costs. This can result in lost time and money compared to purchasing our tenanted, contractually guaranteed properties.

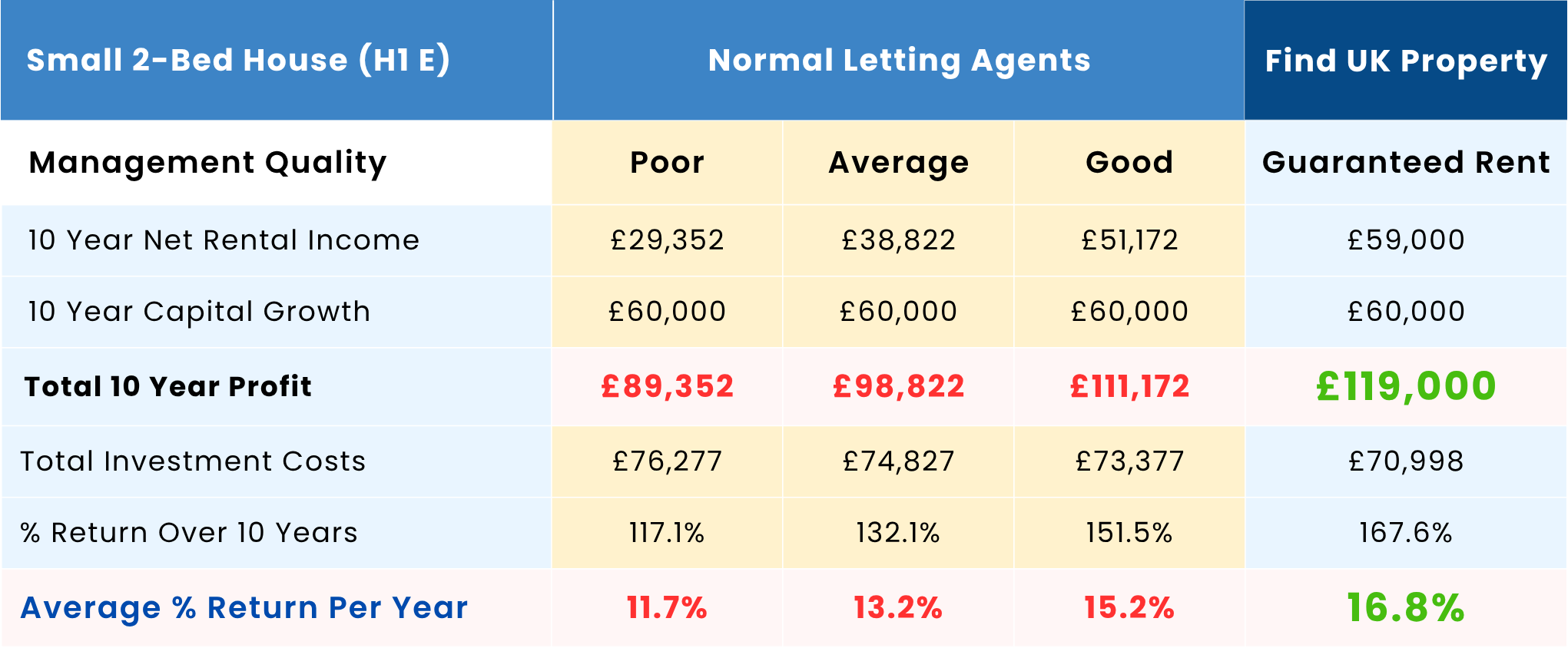

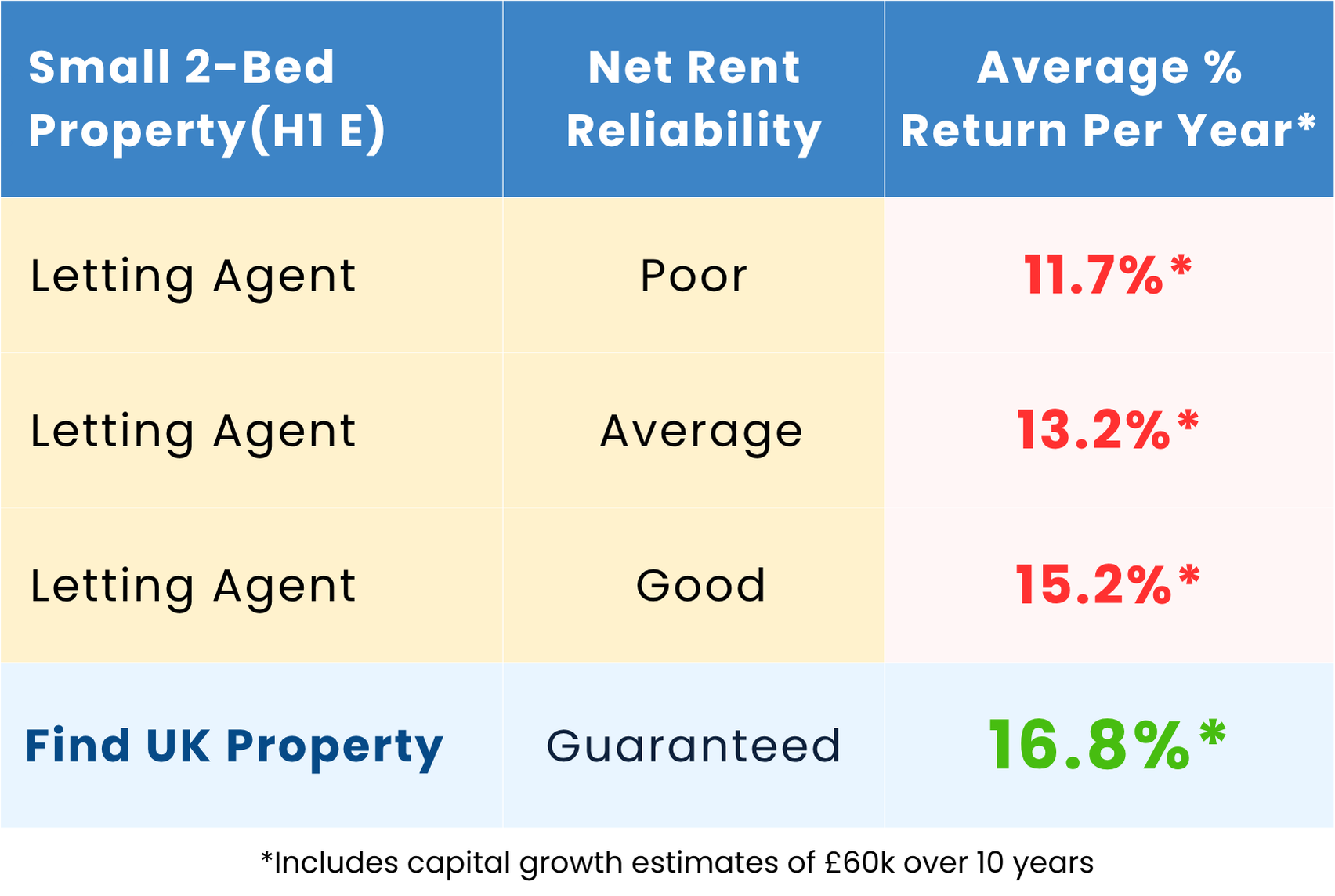

Different To Letting Agents

3 Reasons Why

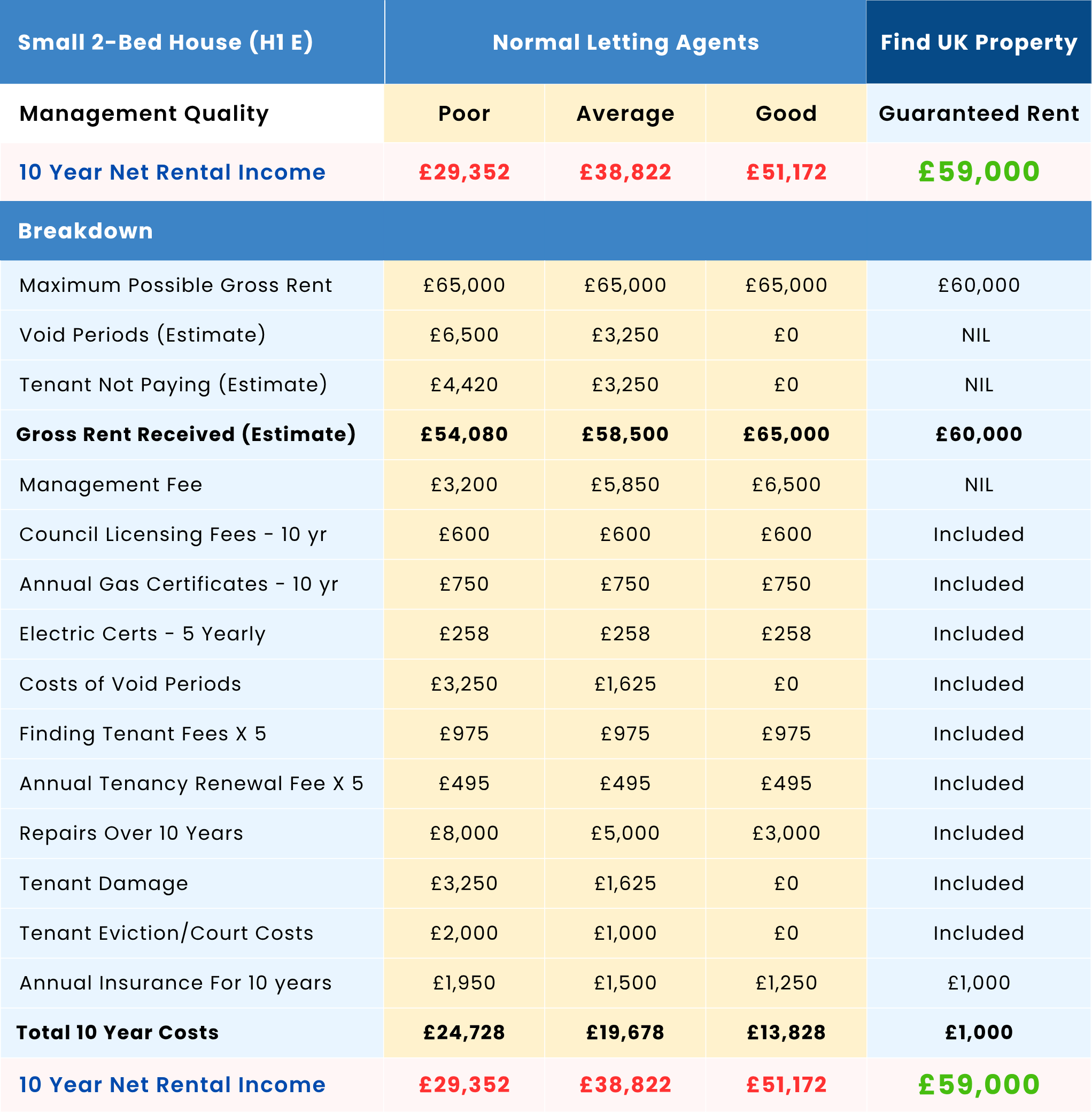

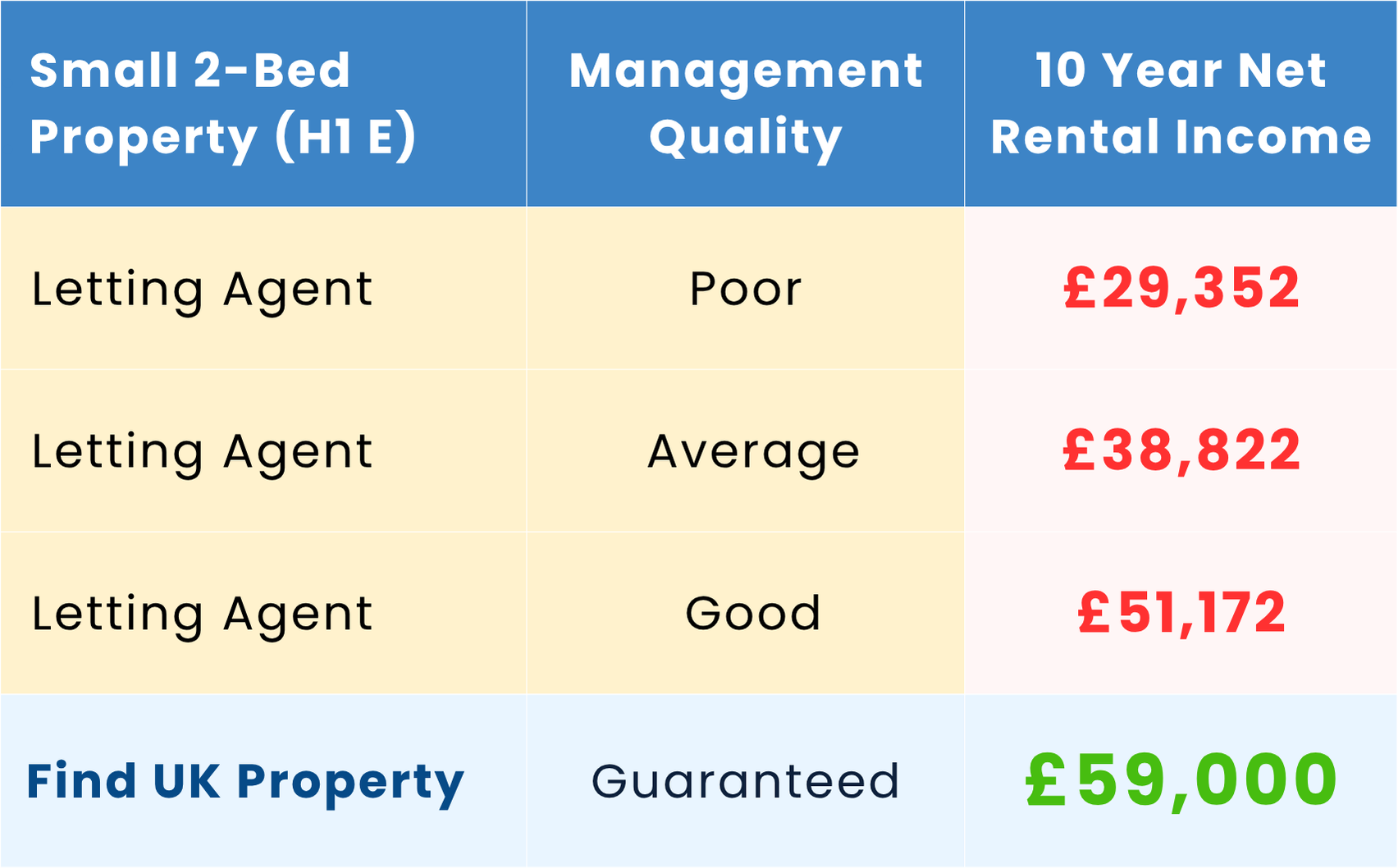

3 reasons your Gross Rent with a Management Agent is likely to drop below our Net Rent Promise.

1. Rent Not Collected

An agent will not guarantee your rental payments.

Find UK Property pays you rent, even when the property is vacant.

Even better, we renovate it to a good, rentable standard each time it is vacant.

2. Management Fees

With VAT this works out at 12% – 18% of your rental income.

We charge ZERO management fees with no hidden costs.

We pay you a percentage of the property price for a minimum of the agreed period.

3. Running Costs

The list goes on and the costs can quickly add up.

We pay for all costs incurred to manage your property for as long as you are our client.

We take on all landlord liabilities and responsibility of your property.

Our Clients Do Not Use Management Agents

Because We Do Everything For Them

You Retain Full Management Control

Retanining management control and full ownership, you simply rent the property directly to us.

We Become Your Tenant

We become your tenants so you always get paid. We then sublet the property to our own subtenants.

We Manage the Subtenants

You don't need to worry about the tenant or the maintenance of the property.

You're Free To Cancel The Tenancy

You can cancel any time with the required notice period. We will move the subtenant to another property.

The way we manage and look after our clients’ properties ensures that overall costs are kept low, as we do everything ourselves and treat these properties like our own.

Because we purchase the properties ourselves initially, then renovate them well up-front, the cost of ongoing maintenance and repairs to us is low but the value to our clients is very high.

The trading model used by standard property agents and management companies is based on increasing the costs to the owner – as their profits are partly linked with this. They make more money with increased maintenance costs and property re-lets. Our model is based on renting the property from you and then treating these properties “like our own” and minimising the costs to us. We achieve this by ensuring our subtenants are supported well and stay in our properties for the long term.

Our clients who become our landlords when they rent the property to us, really like our service and for many it is well suited to their long-term needs. Over 70% of our business every month comes from existing clients or from their relatives, friends or contacts. Often they ask us “How do you do this? How do you deliver such great service and still make a profit?”

There are 3 ways in which we make profit

1. Renovation Margin

We buy well and at a lower price than the market – many of our properties are purchased direct from sellers, before they go to an Estate Agent. We regularly door-drop leaflets in every house in 28 “tried and tested” key areas of the North encouraging sellers to sell directly to us quickly and for immediate cash payment. This saves the seller on agent costs, allows them to sell quickly and means we can buy cheaper. Then we renovate properties fully ourselves, make sure they are complaint, and then rent them out. Due to our buying power and use of our own staff to renovate and rent out, we can make overall savings. This means that we can make a profit whilst still delivering great value for money to our clients

2. We pay you a good fair rent but we get more from our sub-tenants

If we do our job well in getting good tenants and keeping the properties rented out all the time, we can achieve higher rents from our sub-tenants than the net rent we have to pay you. Thus, we can make a profit and cover our costs.

3. Keeping Costs Low

We keep our costs low so that overall business can be profitable. We are efficient and save on costs in 5 areas:

- We do not have to spend time and administration costs in constant liaison with owners as we can take all decisions regarding tenant and property maintenance ourselves as we are the landlord to our subtenants.

- We do not need to do unnecessary repairs – just repairs to keep property in a good condition. Other letting agents make a commission on the repairs they do on your behalf – so it is in their interest to increase the repairs costs – even doing repairs that are not needed. It is in our interest to keep these costs to a minimum. We do this job well ensuring the property is well maintained, always rented out and fully compliant.

- We pay you rent quarterly – again to reduce admin costs and bank transfer fees

- We have qualified electricians, gas safety staff and HHSRS qualified inspection staff. So, we can do all of these compliance items ourselves rather than using external contractors at extra cost.

- Most of our business comes from referrals and repeat business. Thus we have very low marketing costs. We only do a little bit of internet marketing – that is all.

Find UK Property

vs Letting Agents

Renting Comparison with Letting Agents & Open Market

Each Month We Deal With

40+ House Purchases

We Are Always Buying

150 Properties

Under Renovation At Any Time

80+ Clients

In Our Selection Process

Start Your Journey

Simple. Transparent. Honest.

Cost

-

£3,000

Reservation Fee

-

£999

Purchase Cost

-

£70k - £123k

Property Price

-

£99 - £149

Insurance

-

5%

Stamp Duty

Detail

-

One Off. Deducted From

Property Price

-

One Off. Includes:

- Solicitor Fees

- Search Fees

- Land Registry Fees

- 1st Year Insurance

-

One Off. Varies On

Property Type

-

Annual

Year 2 onwards

-

Unless First Property

(+2% for Non-Residents)

-

£3,000

Reservation Fee

-

£999

Purchase Cost

-

£70k - £123k Property Price

-

£99 - £149

Insurance

-

5%

Stamp Duty

-

Deducted From Property Price

-

Includes:- Solicitor fees

- Search fees

- Land Registry Fees

- 1st year insurance

-

Varies on Property

Type

-

Annual

Year 2 onwards

-

Unless First Property

(+2% for Non-Residents)

Taxation

After completion we will also register Non-Resident clients with HMRC to obtain a NRL (Non-Resident Landlord) Reference Number if needed, so that your rental income is paid without deduction of income tax.

With all clients, rental income is subject to income tax unless your UK income is below the personal allowance of £12,570. Thus, if you are not working or are Non-Resident with no UK income, you could buy two average houses (or four as a couple) without paying any tax.

However, an annual tax returns should be filed at end of each tax year. You can do this online yourself, but we also offer an optional tax return service should you need it.

Guaranteed

Find UK Property take responsibility for all costs and pays guaranteed rent, whether the property is tenanted or not. This is contracted legally for a minimum period of 3 or 5 years, depending which solution you choose.

Established

With over 2,500 properties, our scale means we absorb the cost of any issues and remain profitable, to keep paying you the guaranteed rent.

Facilitated Buying Process

- Quicker & Cheaper Than Normal Process

- 10 Easy Steps Contractually Guaranteed