More Property For Less

2 House Offer

Pay For 1 Property

Get The 2nd Up To Half Price

Get 2 Flexi-

Furnished Properties

At Reduced Cost

Buy 1 house now.

Pay for the 2nd house

in 5 years time.

Receive Up To

50% Off Your

2nd Property

Receive a large discount for the 2nd property.

Fixed at today's prices.

5 Year

'No-Rent Period'

Instead

Future rent pays towards 2nd property discount. More property instead of rent.

Tax Efficient

for High Earners

& Family Estates

No rental income means no income tax. Multiple family members allowed.

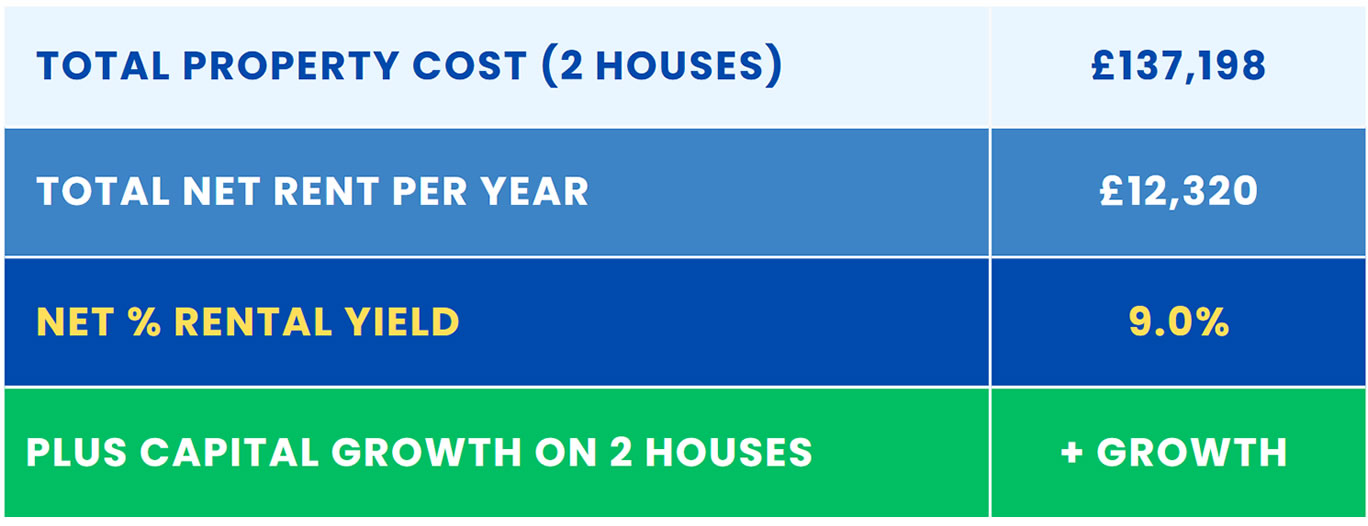

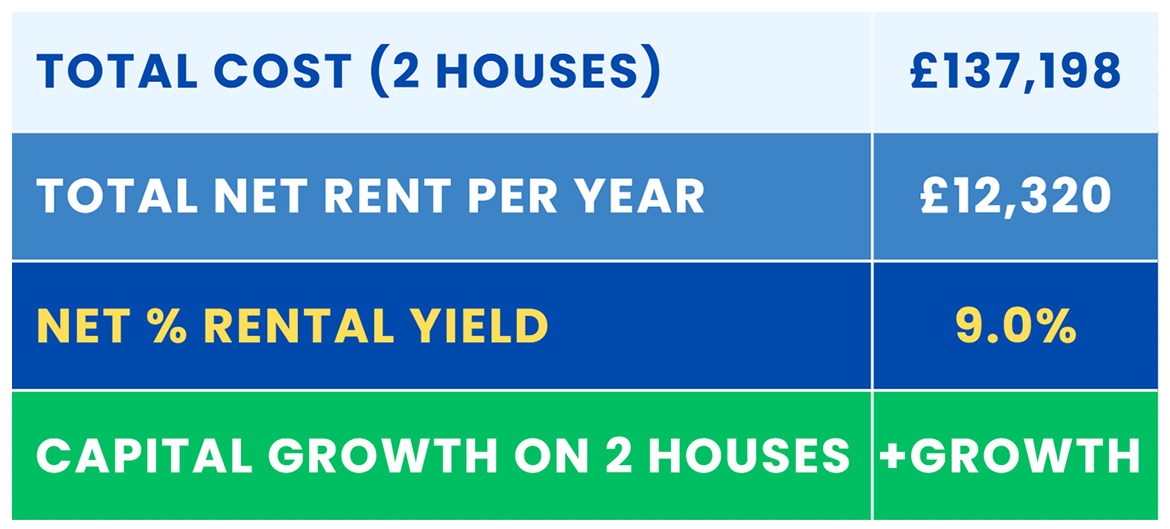

Investment Example

Contractually Guaranteed

Below is an example of the prices, savings, payments and returns on the 2 House Deal.

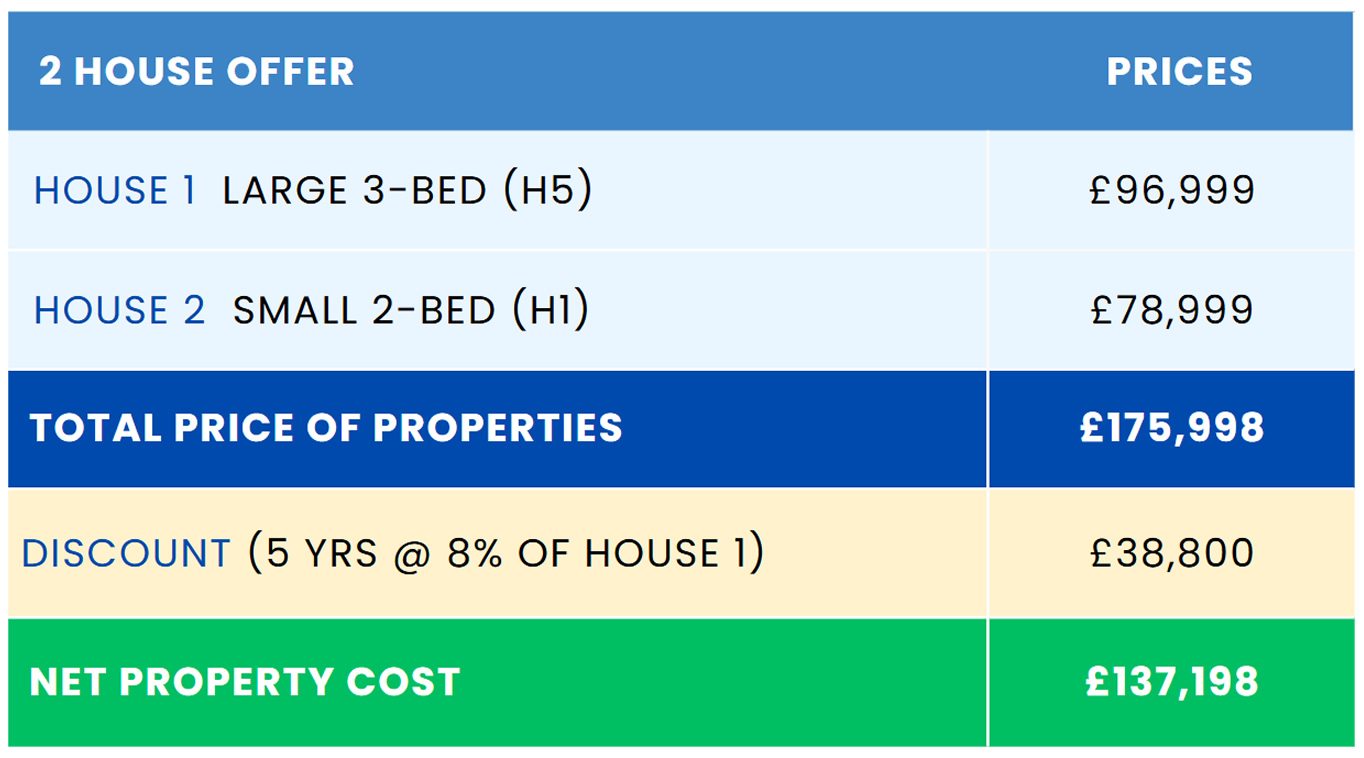

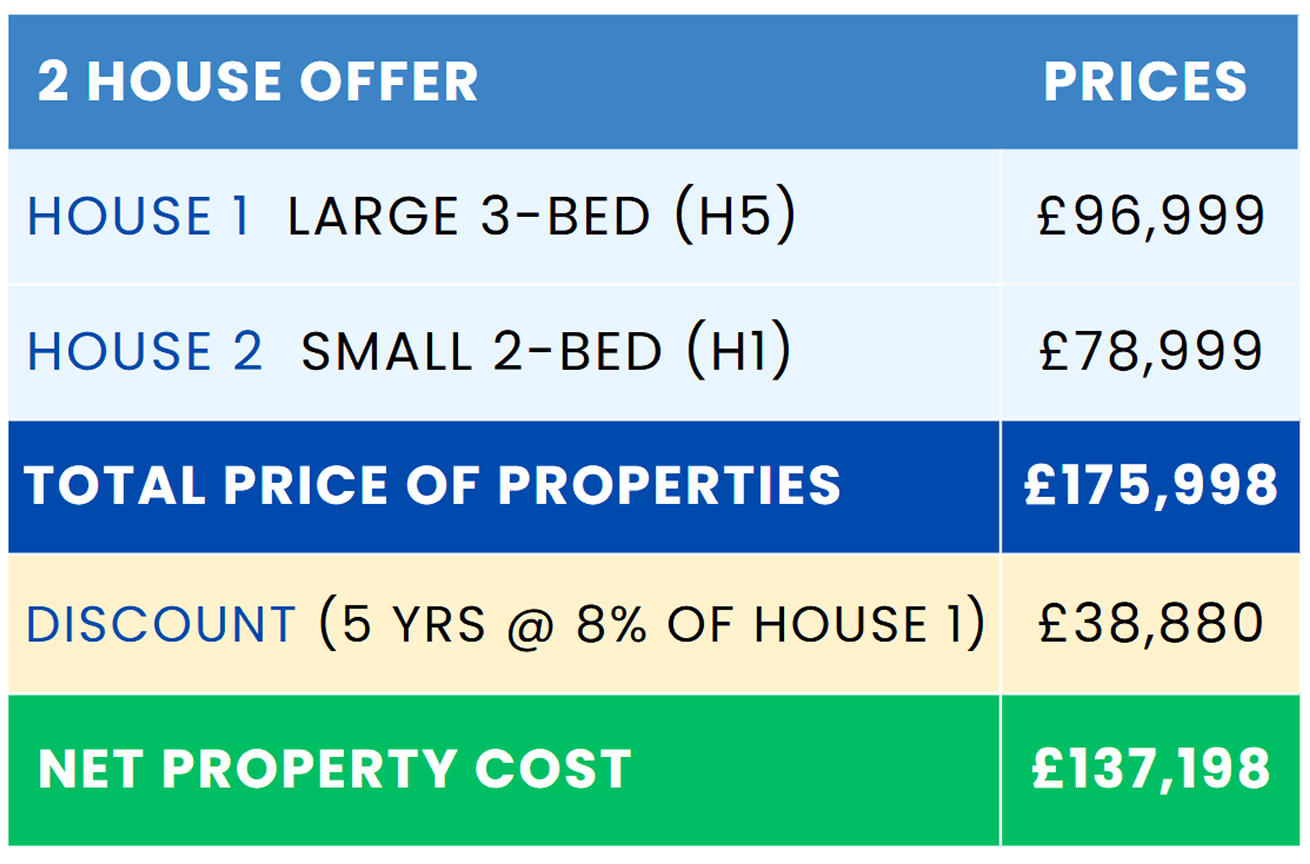

Property Prices & Discounts

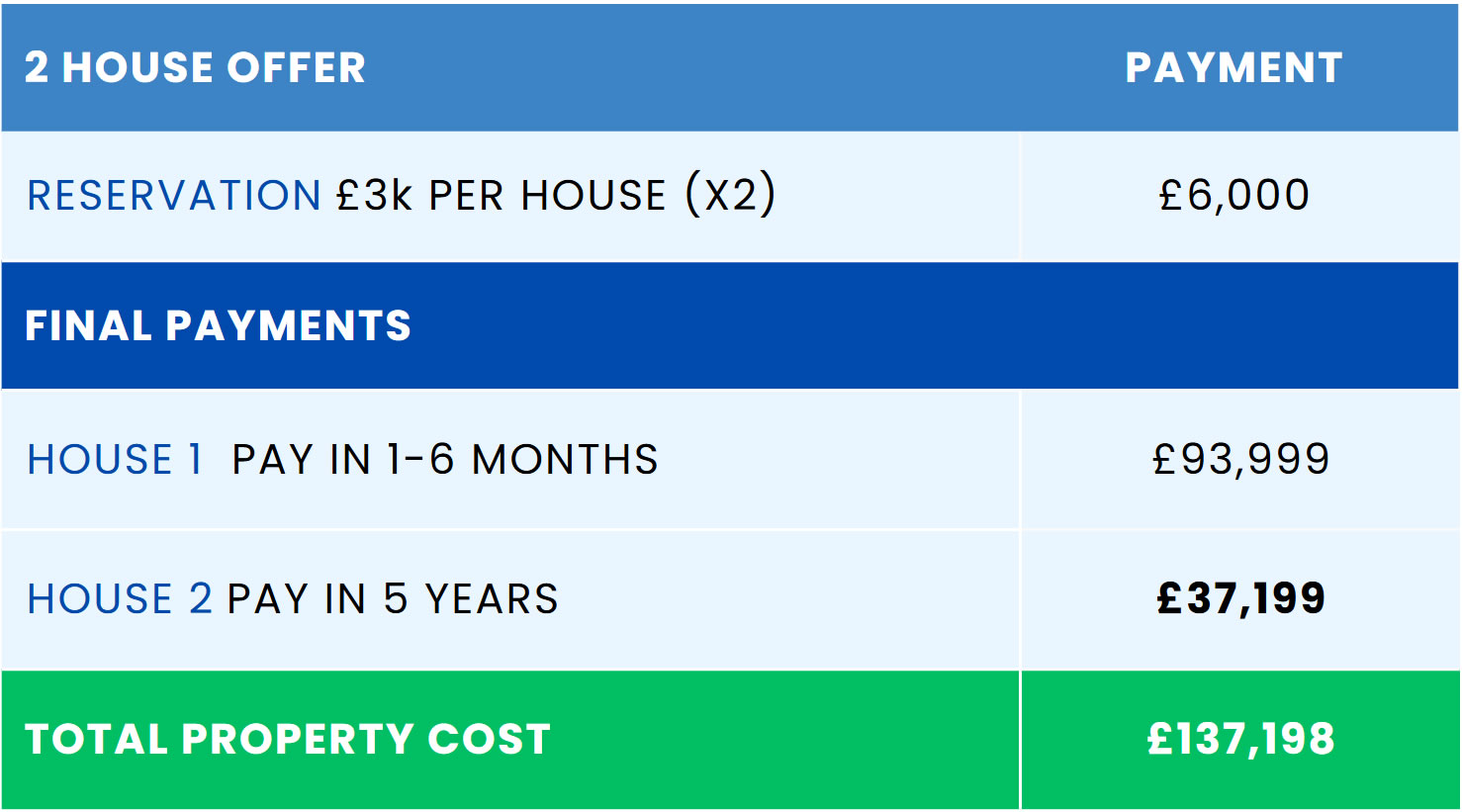

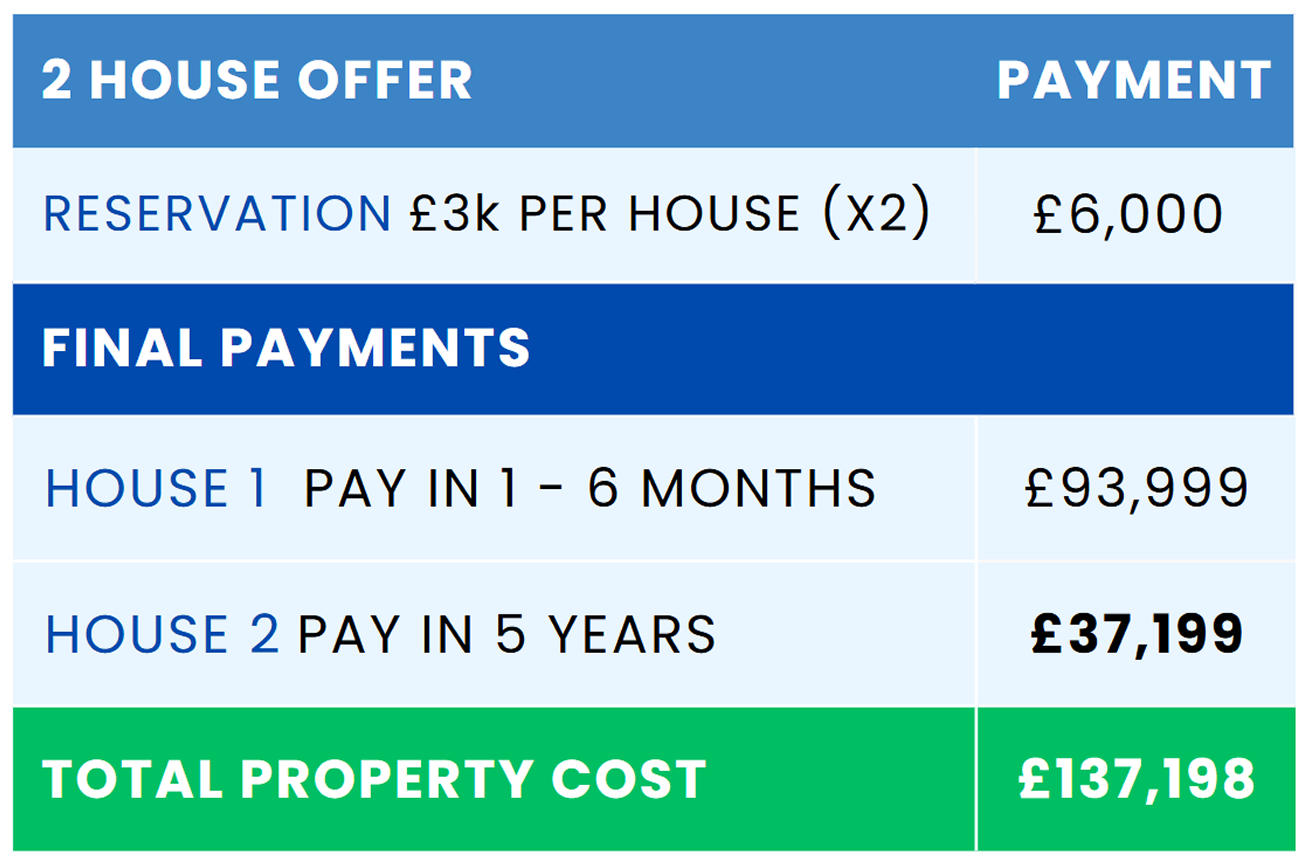

Payment Plan

The figures above are for the Flexi-Furnished Range and do not include stamp duty, or transfer costs of £999 per property.

The 1st property purchased as part of the deal must be a Flexi-Furnished Type H5 or above. The 2nd property can be any house in our Flexi-Furnished range (H1 to H8).

Investment Returns

Want to see the figures for other property types? Our team can tailor a package to suit your needs and discuss the benefits in more detail.

Future Property Prices

Fixed In The Present

Reap the benefit as prices normally increase by around £10,000 over such a period

Your price is fixed at the lower level for the whole of the time range.

The offer is limited to one per client.

Have Questions?

The 2nd property can be any of the property types in our Flexi-Furnished range (H1 through to H8).

However, the first property must be H5 or higher. The example illustrated in the table above uses a H5 for the 1st property and a H1 for the 2nd property, over a period of 5 years.

Yes, you can pay for the 2nd property any time between 1 and 5 years.

The discount on the 2nd property price will simply be reduced accordingly.

For example, if you wish to make the 2nd property purchase half way through the 5 year period, the discount will be half of the amount quoted.

You pay the reservation fee on each property up front – one for each property. This secures the pricing on both properties.

If you need the rental income then this would be a good reason to pay early, as you will start to receive the rental income from this point onwards.

However, if you do not need the rental income before 5 years, there is less benefit in paying early as the discount is of greater value (8%) than the rental income (7%). There is also no tax to pay on the discount, whereas rental income is subject to income tax.

In the example above, there will be no stamp duty to pay on the 2nd property, as the discounted price is below the threshold.

If this is your first UK property then there will be no stamp duty to pay on the first property either.

If you already own UK property then the first property will be subject to stamp duty.

Yes, you can change the 2nd property type when you come to purchase it in 5 years time, or before if you decide to do it sooner.

H1 is default but this can be changed depending on your needs.

Complete Our

Short Form

Complete the short enquiry form on our website so we can learn a bit more about you.

Receive A Draft

Agreement

Speak to a consultant who will then draft a no-obligation agreement for you to consider.

Have A Zoom

Meeting

Meet one of our Directors who can answer any questions you might have in more detail.

Reserve & Select

Your Property

When you're ready, join our reservation list and we will begin the facilitated buying process.

Our facilitated buying process is quicker and cheaper than buying in the open market.

And it’s contractually guaranteed.

Trusted Around The World