Investing In The

UK Property Market

One Of The Most Secure Places To

Invest In The World

Prices

Double Every

12 Years

Based on the past 70 years' data, UK Property has on average, doubled in value every 12 years.

World

Leading

Standards

Comprehensive and frequently updated regulations make the UK one of the most secure places to invest.

Steady Growth

Across All

Regions

Over the long-term, prices increase at broadly the same rate, regardless of which region of the UK you invest in.

Low Cost Property

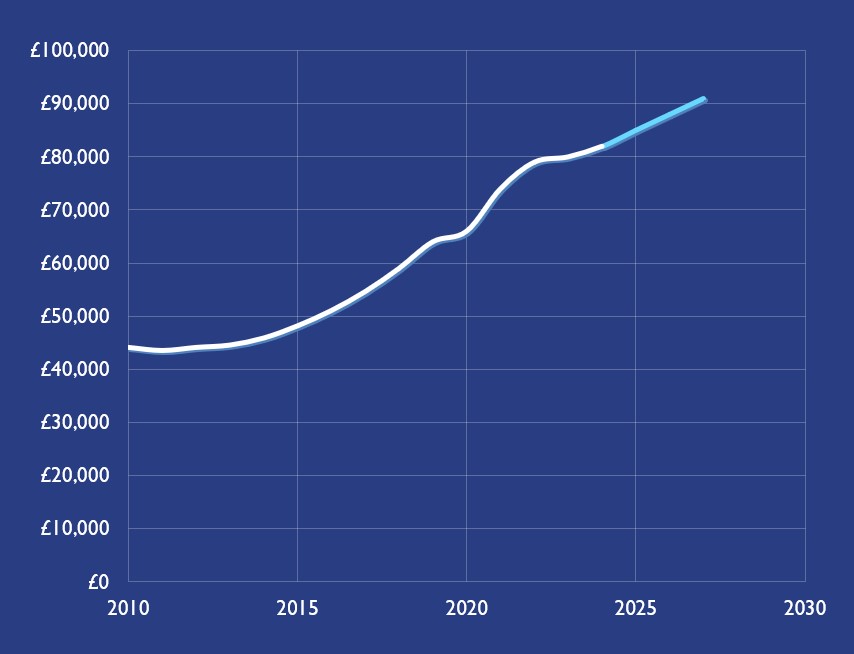

Capital Growth Since 2010

Due to demand exceeding supply, 2-bed terraced houses in the North have more than doubled since 2010. This is despite the global pandemic, recent recession and soaring interest rates.

This chart shows the growth in price of 2-Bed Houses in the North of England since 2010 and the next 3 years projected.

The slow growth between 2010 to 2014 relates to the global financial crisis following 2008.

Higher Rental Yields

Than London & The South

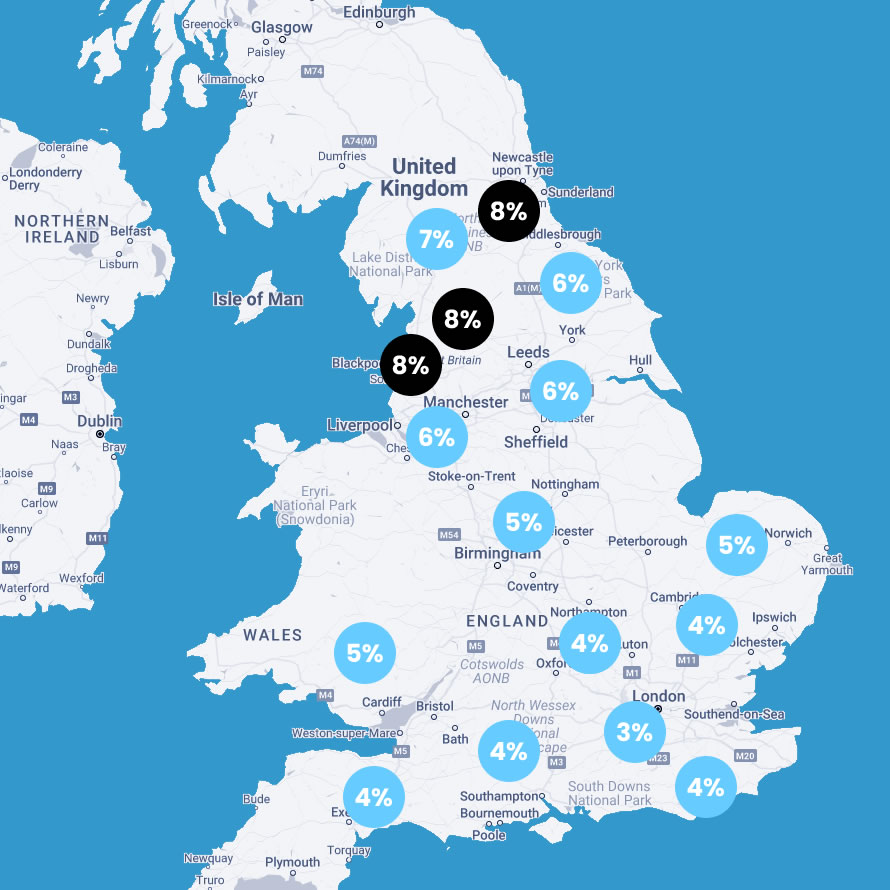

Gross rental yield varies greatly, depending on rental demand and property pricing in each area.

The North West and North East of England deliver the best rental yields in the country, as property prices are still very low and the demand for rental property exceeds the supply.

The rental yields are double that of London and the South.

The best yields are still provided by lower cost terraced houses, which still make up about 60% of the housing market in these areas.

Smart Money Is Moving North For

Freehold Type 1 Ownership

Over the past 15 years, we have identified 28 good neighbourhoods in the North. All of our properties are acquired in these tried and tested areas.

Unlike many property investment solutions, all of our fully managed properties are Category 1 Ownership (Freehold Type). This means you own the underlying asset outright with no hidden costs or risks.

Why Other Types of Investment Aren't Worth It

Other Big Cities

In the major Northern cities such as Manchester, Liverpool, Leeds, Sheffield and Glasgow, properties tend to be leasehold apartments. These may be convenient for own use but they are not the best option for long-term investment.

On the outskirts of these cities, you can find terraced and semi-detached freehold houses. Whilst being cheaper than London, the prices are still 2 to 3 times more than in small towns, but the rents are not much higher. As a result, the percentage yields and investment returns are much lower.

Apartments

Almost all new apartment developments fall into the 99 to 125 years leasehold category and are not suited to long term investment.

With leasehold properties there are service charges, ground rent, and possibly other charges to pay.

In some leases, the service charges can be increased by the developer every 10 years.

The net result is that such apartments, whilst looking good on paper, do not appreciate well over the long term.

Student Accomodation

Whilst there are some projects that offer good value, many do not due to high management/ service costs and short leases (student properties are not freehold).

Prices are inflated with a single mini bedroom in a shared flat costing around £50,000 and they cannot be sold to anyone other than an investor.

The market re-sale value may not rise (and can fall). Typically, these are sold by aggressive sales agents who do not have control over the property and no subsequent contact with the buyer.

Off Plan or ‘Under Construction’

Take extra care when purchasing an investment property that is yet to be built or is under construction.

The risks with such properties remain high as there can be several parties involved including sales agents, builders, contractors, managing agents, leaseholders and land owners.

The project could be cancelled, and there can be delays in completion and therefore renting the properties out. Prices are often inflated by developers as properties are difficult to compare.

Q&A

a. General trend

As stated above, the underlying trend whereby property prices double on average every 10 years, over the long term, is likely to continue to apply to low cost properties. Population growth and limited property stocks in the UK will result in continue long term property value growth.

b. Shift from ‘high cost’ to affordable ‘low cost’ Property

During a recession or negative sentiment relating to economy (due to the factors above), there is cost cutting by consumers. This results in increased demand for property that has lower rent or is lower priced. Prices at the high end do not grow and may fall, whereas prices at low end will rise due to increased demand.

c. Shift from major cities to smaller towns

Many people with office type jobs have discovered that it is possible to work remotely. Many businesses are finding that in some cases remote working of employees from home is actually cheaper for the business. This trend will continue and demand for properties in smaller towns (where we sell houses) will increase. More expensive properties and apartments in major city centres may not increase and may actually fall in price especially during any recession.

d. Increasing Demand from Investors

Rental demand remains strong and investors are increasingly switching from shares, bonds, savings and other ‘paper investments’ to real property which provides more security.

e. Shift in property investment from the South to the North

Buyer are finding that prices near London and the South are very high. Investors are learning that lower cost properties in the North deliver better investment returns. Thus, there is shift in property buying with more buyers considering the North and this trend is likely to increase.

Prices fell in the short-term during 2023, especially in London and the rest of the South of the UK due to high interest rates. In 2024 they have started to rise but at amuch slower rate then the north.

In the UK the best properties for investment are the smaller, lower cost properties. The reason is that these properties are in high demand for rental and thus deliver the best rental yields. Unlike other countries, in the UK small house are more popular than apartments and if well managed, deliver better net rental returns. Here are some Key Point:-

-There are only TWO areas in the whole of the UK where prices on full houses are still low (below £70,000) yet growing well, and rental yields approach 8%. These are East Lancashire in the North West and the wider North East area.

-In the past The North has been depressed with high unemployment but now – over the past 15 years there has been very good recovery (unemployment has fallen from over 15% to 5% in some areas). UK economy has moved from manufacturing to services and online, and many large companies have opened their call centres and logistics/service centres along the Northern motorways due to lower property costs and salaries. Overall the North, especially the North East is expected to do very well.

-The % capital growth on property here is expected to be better than the South over the next 10 years. On average terraced houses like this double in value every 10 to 12 years.

-Rental demand is at the lower end of the market but is strong with a ‘culture’ of rental rather than buying. Around 40% of people rent and the preference is for houses and not apartments.

-Due to general population and family growth in this area, demand for houses has increased and whilst there was plenty of supply in the past, now there are shortages. Recently many developers have started to build new houses on brown field sites and prices on older houses are also increasing.

-The best yields are still provided by old lower cost terraced houses which still make up about 60% of the housing market in these areas. Over the past 15 years, we have identified 28 good neighbourhoods in the North and we try to acquire all new houses in these ‘tried and tested areas’.

-Investment return on property comes from both Capital Growth and Gross Rental Yield. Capital Growth in value in different areas of the UK is surprisingly very similar in % terms over the very long term e.g. 50 years – on average. However, there are variations in the medium to short term (London did very well in the past 15 years but the North is expected to do better in the next 15 years). Overall, on average, UK houses have doubled in capital value every 10 to 12 years for the past 100 years. Gross Rental Yield is the annual rent divided by the value of the property expressed as a percentage. Example – If you buy a property for £100,000 and get £8,000 rent per year. Then the gross rental yield is 8%. The map below shows the gross rental yields % on houses in different areas of the UK. Gross Rental Yield varies greatly depending on rental demand and property pricing in each area. You can see that the North West and North East of England deliver the best rental yields as property prices are still very low and the rental demand is strong.

Assuming a realistic average annual rate of capital growth (the value of your property) of 7%-8%, you can expect a 14-15% yearly ROI. This is the combination of your Net Rental income and the value of your property.

No. This is a misconpetion due to properties being more expensive in London and the South. On average, properties in all areas of the UK appreciate at the same rate. There are fluctuations of course, but over time things level out.

For example, in 2023 and 2024, properties in the North have increased at a higher rate than those in London and the South. High interest rates have been a key factor, as lower priced properties in the North are more affordable and offer greater rent returns.

Choose From 8 Different Property Types

Flexi-Furnished With 7% Net Rent

Our Property Types

7% Net Rent

Fully Accredited And Trusted For 16 Years

Fully Accredited And Trusted For 16 Years

Featured on...

7 Episodes of BBC’s Homes Under The Hammer. Appearing each year since 2018 with more scheduled in the next 12 months.

Featured on...

Here To Help

Speak To An Expert