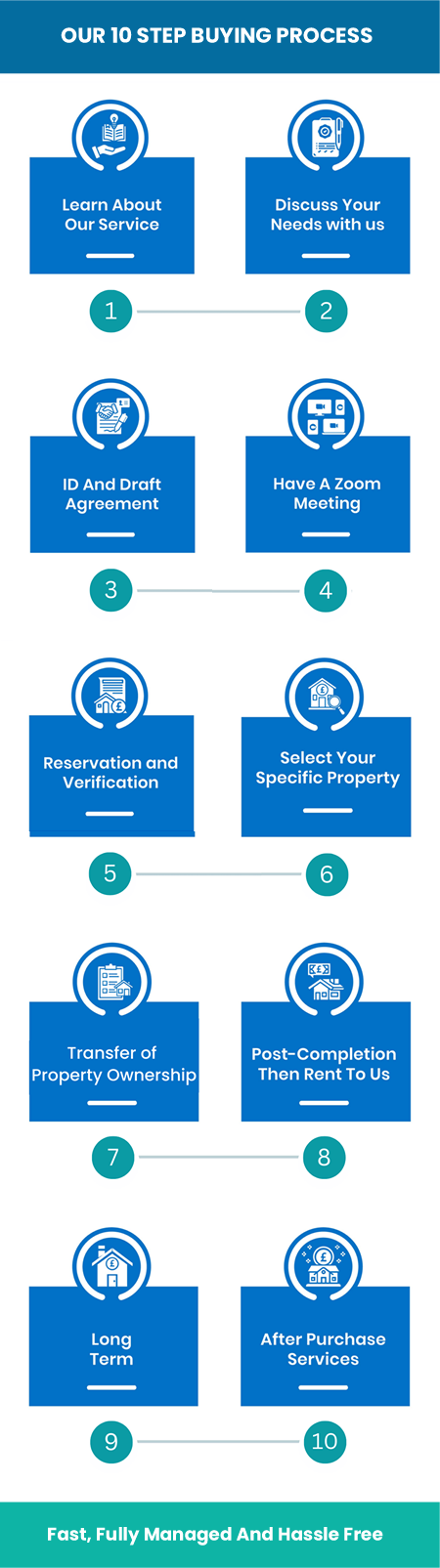

Your Property Purchase

Delivered In 10 Steps

Our 10 Steps Explained

Learn About Our Service

Find UK Property does things differently. Learn about our unique solution and discover how to make a 7% net return.

Watch the Main Video on our home page. Browse the website and see the pricing for each property type. Visit our FAQs and find out what makes us so different when it comes to offering you full ownership with guaranteed passive income.Read More

Discuss Your Needs with us

Fill in our short enquiry form so we can arrange a call with you and identify how we can help with what you're looking to achieve..

Our experienced property consultants will email you with initial information and to arrange a convenient time to speak.

Read More

Is investing in the UK right for you or not?

We aim to provide you with good, honest advice and will tell you if such a property will meet your needs.

.

You can make a provisional decision on the type of property you would like to invest in e.g. a H3. This can be changed later, at the time of property selection in step 7.

ID And Draft Agreement

Provide your ID and proof of address, so we can send you a no-obligation draft agreement.

First you need to decide if the property is to be purchased by a single owner, multiple owners or a company. If multiple owners (e.g. husband and wife) you will also need to consider the type of joint ownership. Most investors go for single person ownership as this keeps things simple. You can amend this at a later stage before property selection.Read More

Your ID information will be required before we can provide official quotes, draft agreements or property sheets. This is a regulatory requirement in the UK. You can scan and email this information to us. We are required by Law to keep all such information confidential. The ID information required will be:

Your Proof of Address can be a Driving Licence, ID Card, Utility Bill or Bank /Credit card statement showing your address.

Once we have your ID information, we can provide more specific details and a draft Reservation Agreement. We will clearly layout how the purchase process will proceed in your particular case. Initially, clients usually make a reservation of the most popular 'H3 Flexi-Furnished' property type. At property selection you can upgrade or downgrade to other types from the entire list. Receiving a draft reservation agreement does NOT oblige you to any purchase – It just provides full information before the video meeting.

Have A Zoom Meeting

Meet one of our Directors who can offer advice and answer any questions you might have in more detail.

Upon receiving your draft reservation agreement, we can arrange a video meeting with a Senior Consultant of up to 1 hour. Many meetings are with our founder, Dr Tariq, who can offer advice and answer all questions. We will explain how we work and the details of the buying process.

Read More

Let us know best times for the video meeting and we will send you a Zoom Video Link.

At the meeting you can ask any questions and we can also advise on who should own the property (single, joint, company) and cover all of your concerns. If you wish to visit, then this can be discussed and arranged after the Video Meeting. The visit is just to provide you with additional confidence and is not normally needed, as the video meeting covers everything.

Reservation and Verification

Join the property selection list by signing the agreement, making reservation payment and providing relevant documentation.

After the Video Meeting and once you are happy to proceed, you can secure your reservation by signing and scanning back the agreement. The property type in the agreement is provisional and can be changed later, after your specific property selection.

Read More

Your reservation payment is £3,000 and remains protected in the client account until property transfer. Reservation means that you have certainty of purchase of any property from the range, a fixed timeline, fixed price, and priority access to the list.

Reservation also allows us to get all your documents ready and ID verified, so that completion can occur immediately after selection. The purchase process starts when you make the reservation. Demand is higher than supply and we do not wish clients to make a reservation until they are confident that what we are offering is what they want.

Due to demand outstripping supply, there is on average a 2-3 week lead time between reservation and specific property selection. Depending on supply this may be shorter or longer. We constantly have around 80 clients in the pipeline who have reserved, with 10 to 12 houses selected each week. Some clients may be waiting until their funds are ready. Your lead-time can be quicker than the average if your final payment funds are ready in advance.

Before selection, ensure that your ID has been verified and 3 months bank statements (showing all the funds needed for the property purchase) or other documents proving source of funds have been returned. Admin staff provide full instructions on how the documents can be emailed to us and how ID verification can be completed.

ID Verification

In most cases ID can be verified remotely by a solicitor via a zoom video call. Our staff can arrange the video appointment with a suitably qualified UK lawyer or solicitor, and in such cases we will pay the verification fee to the law firm. At the Zoom video call, the solicitor will meet you and view your original passport. They will also take a picture of you holding your passport, so they can verify the ID as per the UK Land Registry standards. Such a solicitor will just perform ID verification only and is not involved in the property sales or conveyancing process.

Anti Money Laundering (AML)

Under AML rules, all property buyers must prove the source of funds. The easiest way to do this is to ensure all required funds are in your bank account around 3 months prior to the final payment. Generally, funds that have been present in your account for 3 month are assumed by authorities to belong to you. In such a case, 3 months of bank statement can be provided before the final payment is made from that same account. These can be online statements and do not need to be certified.

If, however, there are any large payments into the bank account in the 3 month period which will be used towards the property purchase, these will need to be explained (e.g. inheritance, property sale, loan, salary, bonus, share sale). Alternatively, a bank statement can be provided of the source of the funds (e.g. another bank account you own from where the funds were transferred).

If any such large payments have been gifted to you during the 3 months period, then a gift letter will be needed, which we can draft, accompanied by a bank statement and ID of the gift donor.

If you provide 3 months of bank statements prior to final payment, and the whole funds required for the final payment are shown as being present at the start of the statements, then further evidence is not normally needed.

Any cash deposits into your bank account cannot be accepted towards UK property purchase as the source of these is hard to prove.

Select Your Specific Property

Once your ID and source of funds have been verified, we can proceed with your property selection.

Based on your guaranteed position in the reservation queue, we give you maximum choice and present around 30 Property Options Sheets for you to select a specific property. These will include the entire range of properties available that week - not just the category reserved, so you can downgrade or upgrade as per your budget and preferences.

Read More

There are also sub-types which are slightly cheaper or more expensive than the main types, depending on their location, value and rent. Each sheet outlines the location maps, street name, pictures, floorplans and details of each specific property. Within each category (e.g. H3) the properties are very similar. We do our very best to price all of them proportional to their value, rent, location and future potential – so you can select any you like. You can select any from the list that suits your budget and preferences.

Study the Property Options Sheets which will be in ascending price order. Take your own preferences into account for budget, looks and location - and select a specific property you like. No matter which you select, your investment returns will be proportional to the set price and contractually guaranteed. The others from your selection list will be released to other clients. If your selected property is still under renovation, we undertake in the agreement, to renovate to the set standard. Your Guaranteed Rent will still start 1 month after the purchase completion date – even if renovation or rental is delayed for any reason.

As the properties in the list may already be rented or be located all over the North, 100’s of miles apart, it is not practical to make visits during the selection process. This system works well for clients and is very efficient. During the Covid Pandemic, over a period of 15 months, we sold over 400 houses without a single property viewing and all our clients were satisfied with their selections. As the properties are guaranteed and will be maintained in a good rentable condition at our cost, viewings do not add any value, and we will provide post-renovation pictures instead of viewing.

If clients are unable to make a selection, they can wait until the next batch of properties. Over 90% of clients select on the first batch, the rest select on the second batch a few weerks later. Only once a client is 100% happy with the selected property does it get transferred to them. After selection, the agreement is amended to the selected property type and pricing. The final payment is worked out and agreed prior to property transfers so everything remains transparent.

If you are buying via the 2-Step Process, you will be allocated an interim property which will be a 1-bed house. You will select your final desired property when you are ready to upgrade to it in 3 years.

Transfer of Property Ownership

We handle the legal completion of your chosen property using the 'Facilitated Direct Buying Process'.

We follow the ‘Facilitated Direct Buying Process’ which is explained in the video below and in our purchasing leaflet. We act on your behalf to ensure all the steps are taken to legal completion of the property purchase after your full payment. This direct process provides certainty, speed and convenience and is underpinned by two main guarantees:

Read More

1. Property Guaranteee

The property will be maintained in a good rentable condition, free of any structural or other significant issues, at no cost to yourself. Should such issues arise in the future they will be fixed at no extra cost. This guarantee remains in place for as long as you remain a client of Find UK Property, and should you terminate the management at any time in the future, the property will be handed back in a good rentable condition, free of any such problems.

This guarantee means that no matter which property you select, it will be renovated and maintained to a set standard at no cost to you. You do not need to worry about the property condition. Surveys and reports are not needed. Even if any issues were to be found on such reports, these would not matter as they will be addressed at no cost to you. On average, a property may be renovated 3 times in a 10 to 12 year period – each time the tenants move.

2. Purchase Process Guarantee

The selected property will be transferred to you with no significant issues with Local Searches and Titles. You become the registered owner of the selected property.

Should there be any significant issues with Searches and Titles, then Find UK Property will offer to exchange the property for any other of the same type, that is acceptable to yourself. As our Group of companies buy properties first, before transferring to our clients, the Searches and Titles are already checked, and confirmed to have no issues prior to transfer. There have never been any such issues in the past. However, the guarantee is provided for additional peace of mind of our clients.

This guarantee means that you do not need to worry about the legal buying process, as this will be done properly and promptly. You will become the owner of the property and will receive all of the documentation.

Prior to completion, checks are made again on Local Searches and Titles. Completion normally takes a few weeks after property selection, if all documents including bank statements and final payments are ready.

Once the property is ready for completion, clients can make the final payment, normally to the same client account as the reservation payment was made. Payments made to the client accounts legally belong to clients until they become the legal owner of the property. Funds cannot be used by the company or solicitors for any other purpose.

Under UK Law, you become the legal owner of the property on the Completion Date. After completion, the property is registered under your name at the Land Registry. Registration takes longer than completion and is normally a few months after completion due to the Land Registry timescales. All your funds including the reservation payment remain in the client account until completion. Our companies only receive the funds and can only use them after you become the legal owner, after Purchase Completion.

Following completion, you receive a completion summary and then 1 - 2 weeks later, other documents. The property is registered under your name at the UK Land Registry and the Title Documents are obtained showing you as the new owner. We will ensure all documents are sent to you as soon as they become available. You can also check your ownership directly with the Land Registry after registration. The Land Registry maintains an on-line register.

Post-Completion Then Rent To Us

Now you own the property, you rent the property to us and we start paying you rent the next month.

You rent your property to us, and we pay you guaranteed rent. Rent starts 1 month after the Completion Date and is paid into your own bank account at the end of each calendar quarter (31 March, 30 June, 30 Sept, 31 Dec).

Read More

Bank Details

We record your bank details (UK or Overseas) on a special form after completion and pay rent at the end of each calendar quarter.

HMRC Application

If you are resident overseas, we register you with HMRC as a NRL (Non-Resident Landlord). This registration service is free of charge. We complete the application and send for you to check, amend, sign and return. If there is a delay in obtaining your NRL reference number, your first rent payment may be delayed until we receive it, but the amount you get will not be affected.

After the NRL number is issued, HMRC will also normally issue a UTR number as you will need to do a tax return the following tax year. You can do this yourself online, but we also have an optional tax filing service where we do it for you. About half of our clients use our optional tax filing service.

Net Rent System

You rent the property to us as per the commercial agreement, to rent and sublet. We are your tenants and agree to pay net rent at 7% of your property price per year, for all Flexi-Furnished houses and we agree to keep your property in a good condition at our cost. We then sublet to our own tenants and are the Landlord of the property. We do everything, you do nothing and get passive income for the long term. However, you retain full management control for peace of mind and there are no managing agents.

With the 2-step Process and DIY deals, you give us a rent-free period. Instead of receiving rent, you build discount on your final property price.

Long Term Rental

Rent to us for the long term. Earn guaranteed passive income with none of the usual hassles of owning rental property.

Most clients want to keep their properties for the long term. We are set up to provide services for 30+ years and our clients like our hassle free service. 50% of our sales each month are linked to existing clients.

Read More

However, you do have the option after the first 3 years, to give us 6 months notice if you wish. The tenant will be moved to one of our nearby properties and the property will be handed back to you in a good, rentable condition.

After this you can live in your property, rent it out yourself, use any agent or re-sell it.

The agreement continues after the minimum 3-year period, unless you give notice to cancel. Our aim is to ensure you never need to leave us – unless you wish to resell. Over the past 16 years, only approximately 100 properties have been resold by clients (out of over 2,500). In every case, we have agreed to match the market price and buy back the property to make it quick and easy for clients to free up their capital.

Only a handful of clients have ever given us notice to live in their property, manage it themselves or move to another agency.

We have never given notice to any client, for us to stop managing their property, and we do not intend to do so.

After Purchase Services

We believe in making life as easy as possible for our clients, in all aspects of managing their property investment.

Annual Tax Filing Service

Read More

We are official HMRC Tax Agents and can file your tax returns for you. Even if your rental income is below the minimum threshold, tax filings still need to be made each year if you own a UK investment property.

UK Will Service

Ensure that you decide who will own your estate after you. Don't leave the decision in the hands of the state. Our partner company Pendle Legal Services offers Inheritance Planning and Wills Services.

Non-Resident UK Bank Accounts

We can provide reference letters after a property is registered, to help you open a UK Bank Account.

Owning a property in the UK is a valid reason to open a non-resident bank account in order to deposit your rent. However, you may need to physically go to a branch with your ID and documents in order to do this.

A UK bank account is not essential as rent can be sent to any of your overseas bank accounts. With your permission, it can also be paid to a first degree family member. (We will need the ID and bank statement of the family member, prior to any payments).

Future Resale

You can resell easily in the future and we can also buy back at the market price. However, you should not buy a property with us if you wish to resell quickly e.g. within 2 or 3 years, as you are unlikely to make much profit.

Why not start your property journey today by speaking to a member of our team?

All you need to do is fill in a short form and provide us with a few basic details.

Lower Costs Than An Estate Agent

Every property we sell is owned by our Group of companies. When we sell it to you, there is no 3rd party involvement. We complete a property purchase quicker than any estate agent or solicitor can.

See how we compare to Estate Agents.

More Guarantees Than A Letting Agent

With over 2,500 properties, our scale means we absorb the cost of any issues and remain profitable, to keep properties maintained and keep paying you the guaranteed rent. No ordinary letting agent offers this.

See how we compare to LettingAgents.

Choose Your Property Type

Earn 7% Guaranteed Net Rent

Select from 8 different property types depending on your level of investment. From H1 to H8, starting with Small 2-Bed houses through to 3-Bed Semi-Detached properties..

Tried, Tested & Trusted

Fully Accredited For 16 Years

Fully Accredited For 16 Years