UK Investment Property

We Provide Low Cost Property that is suitable for Overseas Buyers, UK Expats and Investors from London and the South. You can treat the property as an investment and rent out yourself, use any other letting agent to rent out, or rent to Find UK Property – the best option for passive investors. If you rent to Find UK Property, then we pay you an agreed Net Rent depending on your property type (7% Net Rent for all of our Flexi-Furnished Houses which aren ow our standard range. This is guaranteed for a minimum of 5 years) and keep the property in a fully compliant and good rentable condition at our cost. We sublet to our own tenants at a higher rent to ensure we cover our costs and make a profit. We have clients who have been renting to us for over 15 years.

The UK is one of the world’s best areas for secure property investment. Prices on low cost houses have on average, doubled every 10 to 12 years for the past 60 years.

Find UK Property provides a complete service to property investors from the UK and Overseas. Our view is that lower cost houses of £70,000 to £120,000 provide the best value for investment and will produce the best capital and rental growth over the long term.

Best Buy Investment Properties

These Best Buy investment properties listed below are already rented out to our subtenants. They are low cost, give high rental yields and are expected to grow well in value over the next few years; and are easy to resell. We continually acquire, rent out, sell and subsequently rent and sublet such property. Our clients buy the properties and then rent them directly to us. We become their tenants. This system allows the investors to retain full managmenet control of their property whilst becoming passive investors. These properties are the most popular purchases made by our UK investors, expats and overseas buyers.

Location

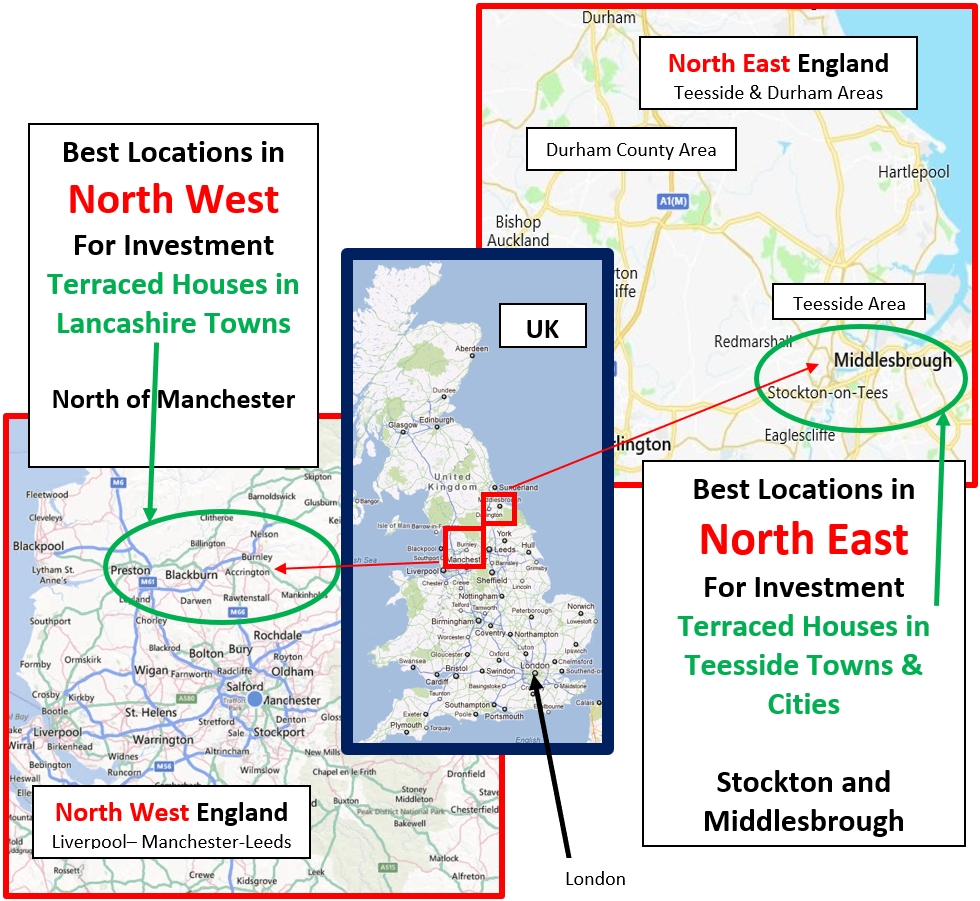

Traditionally there have always been TWO popular investment hotspots – London and the North of England (North West and North East regions). Now London is very expensive, rental yields are much lower and there is more uncertainty with future growth due to high interest rates negatively affecting high cost properties. Thus the best area is the North West and North East of England as shown on the maps below. Here demand is increasing as investors switch from South to North. All of our properties are located in 28 areas in the North. Majority are in the North East located in towns north of Leeds – such as Middlesbrough, Stockton, Darlington, Hartlepool, Teesside, Durham County (TS, DL and DH post codes). We also have Type H2L, H3L, H4L and H5L houses in the North West, mainly in the Lancashire towns north of Manchester, and prices on these are £10,000 higher than the prices shown. (rents on these are also correspondingly higher).

Thus these Best Buy investment properties are not in London (property in London is already very expensive with low rental yields of about 3% gross and possible low future capital growth). These properties are located in high rental demand residential areas in the North. Here is an aerial view of a typical town in these regions.

A typical Northern town consists of terraced properties near the town centre and more expensive semi-detached and detached properties in the suburbs. Rental demand is highest for the terraced low cost properties. Below is an aerial view of a typical town area near the centre with terraced properties.

The terraced properties that lie near to shops and main roads and are walking distance from the town centre or have good bus routes are the best for investment and we always acquire these as we have to provide guaranteed rent.

A typical terrace consist of rows of 2-bed or 3-bed houses like the picture below. In the past year alone over 300 such properties have been sold to investors. If you are not sure which UK property to buy – then buy one of these. The most popular types (our Best Buy offers) are listed below on this page

Type of Property – Terraced House

These are the standard commodity properties in this part of the UK and are normally built of real stone or brick, with slate roofs. Almost 80% of the population live in these type of properties. About 60% are owner occupiers and about 35% to 40% are in the investment/rental market. All properties are fully fitted with kitchens, bathrooms, carpets, central heating etc. but do not include loose furniture. It is standard to rent out unfurnished as this has less liabilities for the owner. A small percentage of the investment properties we sell are larger semi-detached houses which also represent very good value. Such properties (e.g Type H6 to H8) have large gardens and are more modern design. they attract larger families that stay longer as tenants.

Full Property Management & Rental Yield

Letting Agents

Other companies work as Letting and Managment Agents and may quote higher rental yields but these are the Gross Rental Yields which on these properties average 8%. However there are 3 Main reductions which other agents will make:-

- 1.Rent Not Collected. This may be due to property being vacant or tenant not paying or any other reason. This may drop the yield on average by 1% to 7%

- 2.Management Fee. The fee charged by other agents is 10% to 15% plus VAT = (12% to 18% of the rent. This will drop the net rent paid further to less than 6% rental yield.

- 3.All Other Costs. E.g. Costs of property repairs, maintenance, compliance costs, tenant damage or tenant eviction costs etc. These can be significant and may vary greatly – further reducing net rent paid. Furthermore they create anxiety for owners due to uncertainty of the costs.

We do not use this system. Instead, you agree to rent the properyt directly to us, and still retain full management control. Thus there are no managing agents and you save on management fees. We pay you a fair Net Rent and agree to keep your property in a good condition – so you have none of the above costs. Our owners know in advance the exact rent they will receive, there are NO management fees and all costs are covered.

Our System – Net Rent 7% – For minimum of 5 Years.

This is the system we operate with all of our clients. This is the most important figure and the net rent you get into your bank account after ALL costs and is guaranteed – no matter what. For H1 type house costing £75,999 you get total Net Nent of £5,320 per year. On top of this you get capital growth in value with houses expected to double in value over next 12 years.

- -You always get the Net Rent – becuase we agree to pay this in our agreement – no matter what

- -There are NO management fees to pay us as you have management control. We agree to pay ALL costs as pert of our rental agreement with you.

- -All costs are covered as per our rental agreement with you.

This is the system we operate as default. The standard Net Rent increases after the first 5 years at the end of each calendar quarter – in line with rental prices.

What is Flexi-Furnished?

Normally in the UK, properties are priced and rented unfurnished. Recently, the demand for furnished has increased from certain types of tenants, who are willing to pay higher rents. Flexi-Furnished means that the property is provided with furniture to meet the exact needs of the tenancy. This allows us to charge the maximum rent for each property (to our benefit) as the property is made more suitable for the tenant, whilst keeping our costs low. Your rent does not change and you always get the “Flexi-Furnished” rate of 7% Net Rent.

Future Net Rent

After the 5 years, the Net Rent is expected to increase each year in line with rental prices. The increase will be from 1st January after the 5 years have ended.

Category 1 – Full Ownership

All houses are category 1 ownership. This means freehold or 999 years (almost 1,000 years leasehold). There is no difference in value between these two. This is the best form of ownership in the UK. (We do not sell category 2 properties that are 99 years or 125 years leasehold). All of the houses in the North East are pure freehold. Most of the houses in North West of UK are leasehold for 999 years with nominal (less than £1 per year) ground rent.

Purchase Costs

The purchase costs are negotiated and fixed at £999 and include solicitor costs, local searches, 12 month’s insurance and land registry fees.

3% Stamp Duty & Non UK Resident Stamp Duty of 2% if applicable

The buyer has to pay the 3% stamp duty fee. If you do not own another residential property you can get exemption. The amount of fee on our lowest cost H1 type of property would be £2,100. If you are not resident in the UK, then there is an additional 2% Stamp Duty.

Total Costs for H1 House (£75,999 + £999 purchase costs + £2,280 stamp duty) = £79,278

Payments and Steps

There are TWO key stages of the Reserve & Select Process: – Reservation of a type of property and then Selection of Specific property about 5 weeks later. Clients normally make a reservation of the “Best Buy” H3 Type first. At property selection they can upgrade or downgrade to other types if they wish.

- Discuss, then Provide ID Information and get agreement

- Have a Video Meeting and then Visit if possible and Sign Agreement once happy

- Make £3,000 reservation payment. There can be an agreed gap of up to 6 months between Reservation and Final payment if requested by Buyer. Normally 1 to 2 months.

- Review Property Option Sheets and Agree Specific Property normally 5 weeks after reservation.

- Payment of rest of property (minus £3,000 already paid) plus any stamp duty and purchase costs £999.

- Purchase Completion & Registration at Land Registry. Net Rent starts 1 month after Purchase Completion.

- Net Rent is paid at end of each calendar quarter into any nominated bank account (overseas or in UK) belonging to owner.

Resale

Clients can resell their properties at any time and can use us, other agents, or themselves. We advise clients not to purchase if they are looking to resell within 3 years as they will not make much profit due to buying and selling costs. Most clients are buying for long term investment and for such a purpose, these properties are ideal. If you buy and immediately resell you will lose money.

HMRC and Tax

We guide you to make this easy for you.

Registration as Non-Resident Landlord (NLR)

After completion, if you are resident abroad, we register you with HMRC to obtain a NRL Reference Number (if needed) so that your rental income is paid without deduction of any income tax.

Annual Tax Free Allowance

All nationals of UK, EU and most other countries are eligible for the UK personal allowance. This is a very good benefit for retirees, foreign buyers and expats. Currently this is £12,570 per person per year (A couple thus have £25,140). Thus any rental income below this level would be tax free. A couple could own 5 or 6 such properties without paying any tax.

Tax Returns, Filing and Paperwork

We can provide a service to do the annual tax return and other HMRC paperwork for you, for a small annual fee.

Insurance Fee

The annual insurance fee is the only cost that is client’s responsibility (as insurance cannot be paid by third parties and must be paid by owner and beneficiary). Full buildings insurance for a typical 2-bed house is negotiated to only about £99 per year. The first years’ fee is included in the purchase costs and is thus not charged separately. In future years, we handle this for you and add the fee to your statement and take it from your rent each year. This may vary from £99 to £149 per year depending on property type.

There are no other ongoing costs for clients. All utilities and any council/community tax is paid by tenant (or by our company if property is empty). All repairs and property maintenance are our responsibility.

Visits to Head Office

We are happy to meet you at our offices – although visits are not required in the entire process. All of our processes and systems work very well via video meetings and emailed documents etc. During the peak of the Covid crisis we sold over 400 houses in a 15 month period without any viewings and all of our investors were happy with their selections via property sheets and pictures. This is the process we now follow and in additiona we contractually guarantee the property and the buying process – so that it is more secure. The only reason for visits is prior to reservation in order to gain confidence with the company and to check our operations for yourself. Any visits should be pre-arranged and booked in advance. One of our staff will meet you at our main reception and show you around. We can take you to a nearby town and show you examples of property that are vacant. However you will not be able to select properties at such a visit or view any property from the inside if it is tenanted.

If you are a new client we would only arrange such a visit after you have received the reservation agreement and had a zoom video meeting first. This will enable you to decide if such a visit is worth pursuing. A visit will give you more confidence in the company and allow you to check that everything we say in the Main video and website is correct. After the visit, once you are happy, you can proceed with the reservation.

- Arrange video meeting prior to visit. and agree time and date for the visit.

- Arrive at our offices on time (Main Reception, Time Technology Park, Blackburn Road, Burnley. BB12 7TY. UK.). A good arrival time is around 11am.

- One of our team will meet you and show you around. They can take you to a nearby town and show you examples of property that are vacant. However, you will not be able to select properties at such a visit or view any property from the inside if it is tenanted.

- After the short visit, you can have a meeting with senior staff. As we have several offices, this may be via video link, if senior staff are not present at the office.

- After the meeting you can decide if you wish to proceed with a reservation or not. The whole visit will last less than 2 hours.

Why we avoid tenanted viewings

The reasons why it can be difficult to arrange viewings when properties are tenants are as follows:-

- -The tenants have rights regarding viewings and may not agree to a specific time that is not suitable for them. For example, if they are working, then it may not be possible to do the viewing during normal working hours. Out-side of working hours, our own staff may not be working and so it is difficult for us to show the owner around.

- -In the current post “covid” climate, tenants have additional rights and have the right to refuse viewings and it can be difficult and tedious to enforce owner’s viewing rights legally.

- -Some tenants get nervous about viewings as they fear that owner may be looking to resell and evict them (even where explanations are provided, that this is not the case).

- -Under our system, the owner is a passive owner as we are the “landlord” of the property. The AST tenancy agreement is thus between us and the tenants. The owner is not involved. Thus, legally, the tenant does not have legal liabilities to the owner and can refuse viewings.

Due to these reasons, we avoid viewings of tenanted properties and try to arrange viewings in-between tenancies when properties are vacant.

Property Selection Sheets

When purchasing such properties from Find UK and partner companies, you will be guaranteed a minimum specification and standard of property so that you can confidently make a reservation. Reservation is made by signing the reservation agreement and lodging £3,000 payment into the client account. Reservation gives you certainty of purchase, a fixed timeline and priority access to the selection list which will be around 20 houses for each client. It also fixes the price for the entire range to the prices that were prevalent at time of reservation and secures any special offers. All of our properties in the list are priced correctly according to their value and investment return and meet the minimum specification of each type. Clients have the ultimate final choice on which specific property they wish to select from the list. This Selection process happens about 5 to 6 weeks after reservation due to the demand and priority is given by reservation order. Please watch section 2 of the video for a full explanation of the Reserve & Select proc

ess and why this is better than buying in the open market.

All recommended specific properties will be as per the details, floor plan, pricing, and rental shown in the following sheets. All Fees and Costs are also shown here.

Offer H1: Small 2-Bed Houses – £75,999 – Flexi-Furnished

House Layout

Two small rooms downstairs (Lounge and combined Dining room/kitchen with rear yard and two small bedrooms plus 3-piece bathroom. These are fully renovated houses and are located in slightly lower rental areas than H2 houses shown below.

Rental Yield

We offer the Net Rent System as standard.

Property Sizes for Type H1

- -Lounge – 12ft by 13ft. (3.7m by 4m)

- -Dining Kitchen – 12ft by 10ft. (3.7m by 3m)

- -Bedroom 1 – 10ft by 13ft. (3m by 4m)

- -Bedroom 2 – 9ft by 8ft. (2.9m by 2.5m)

- -Bathroom -10ft by 6ft. (2.9m by 1.9m)

- -Rear yard/garden – up to 15ft by 13ft. (5m by 4m)

- -Car parking: ample free car parking on street

Purchase Costs and 3% Stamp Duty

The purchase costs are negotiated with third parties and fixed at £999 and include solicitor costs, local searches, 12 month’s insurance and land registry fees. The buyer has to pay the 3% stamp duty fee. If you do not own another residential property (anywhere in the world) you can get exemption. The amount of fee on this type of property would be £2,280. Total Cost (£75,999 + £999 purchase costs + £2,280 stamp duty) = £79,278. If you are not resident in the UK, then there is an additional 2% Stamp Duty.

You rent to us – We agree to cover all costs and keep properyt in good condition

We rent to our own subtenants and thus all of these are NOT your responsibility. They are our responsibility.

- -Annual Gas certificates and -Electrical Certificates

- -All Repairs of any nature (e.g. plumbing issues, leaks, roof and boiler problems)

- -Council tax and any other bills during void periods

- -Tenant Damage, Eviction and Court Costs

Payments and Steps

- Discuss, then Provide ID Information and get agreement

- Have a video meeting and Sign Agreement once happy

- Make £3,000 reservation payment. Buyer can request a gap of up to 6 months between Reservation and Final payment if needed. Normally 1 to 2 months.

- Agree Specific Property (5 weeks after reservation)

- Payment of remaining price (minus £3,000 reservation) plus stamp duty and purchase costs

- Purchase Completion & Registration at Land Registry

- Net Rent starts 1 month after Completion date and is paid at end of each calendar quarter into any nominated bank account belonging to owner.

Offer H2: 2-Bed Houses – Flexi-Furnished – £79,999

House Layout

Two rooms downstairs (Lounge and combined Dining room/kitchen with rear yard and two bedrooms upstairs plus 3-piece bathroom. These are our best selling investment houses and the ones that are in the highest rental demand.

Property Sizes for Type H2

- -Lounge – 12ft by 13ft. (3.7m by 4m)

- -Dining Kitchen – 12ft by 13ft. (3.7m by 4m)

- -Bedroom 1 – 12ft by 13ft. (3.7m by 4m)

- -Bedroom 2 – 10ft by 8ft. (3m by 2.5m)

- -Bathroom -10ft by 6ft. (3m by 1.9m)

- -Rear yard/garden – up to 20ft by 13ft. (6m by 4m)

- -Car parking: ample free car parking on street

Purchase Costs and 3% Stamp Duty

The purchase costs are negotiated with third parties and fixed at £999 and include local searches, 12 month’s insurance and land registry fees. The buyer has to pay the 3% stamp duty fee. If you do not own another residential property you can get exemption. The amount of fee on this type of property would be £2,400. If you are not resident in the UK, then there is an additional 2% Stamp Duty.

Total Cost (£79,999 + £999 purchase costs + £2,400 stamp duty) = £83,398

Offer H3: Large 2-Bed Houses – Flexi-Furnished BEST BUY- £85,999

House Layout

Three rooms downstairs (Lounge, Lounge 2/Dining Room and separate kitchen with rear yard and two bedrooms upstairs plus 3-piece bathroom. Clients normally make a reservation of this “Best Buy” H3 Type first. At property selection they can upgrade or downgrade to other types if they

wish.

Property Sizes for Type H3

- -Lounge 1 – 14ft by 13ft. (4.3m by 4m)

- -Lounge 2 – 12ft by 13ft. (3.7m by 4m)

- -Kitchen – 8ft by 6ft. (2.5m by 1.9m)

- -Bedroom 1 – 14ft by 13ft. (4.3m by 4m)

- -Bedroom 2 – 11ft by 8ft. (3.4m by 2.5m)

- -Bathroom -10ft by 7ft. (3m by 2.1m)

- -Rear yard/garden – up to 20ft by 13ft. (6m by 4m)

- -Car parking: ample free car parking on street

Purchase Costs and 3% Stamp Duty

The purchase costs are negotiated with third parties and fixed at £999 and include solicitor costs, local searches, 12 month’s insurance and land registry fees. The buyer has to pay the 3% stamp duty fee. If you do not own another residential property you can get exemption. The amount of fee on this type of property would be £2,580. Total Cost (£85,999 + £999 purchase costs + £2,580 stamp duty) = £89,578. If you are not resident in the UK, then there is an additional 2% Stamp Duty.

Offer H5: Large 3-Bed Houses – £92,999

House Layout

Three rooms downstairs (Lounge, Lounge 2/Dining Room and separate kitchen with rear yard and three bedrooms upstairs plus 3-piece bathroom.

We also have small 3-bed houses Type H4 at £86,999 and Large 3-bed houses with front and rear gardens (type H6) at £99,999

Property Sizes for Type H5

- -Lounge 1 – 14ft by 13ft. (4.3m by 4m)

- -Lounge 2 – 14ft by 13ft. (4.3m by 4m)

- -Kitchen – 8ft by 6ft. (2.5m by 1.9m)

- -Bedroom 1 – 14ft by 13ft. (4.3m by 4m)

- -Bedroom 2 – 11ft by 8ft. (3.4m by 2.5m)

- -Bedroom 3 – 10ft by 8ft. (3m by 2.5m)

- -Bathroom -10ft by 7ft. (3m by 2.1m)

- -Rear yard/garden – up to 20ft by 13ft. (6m by 4m)

- -Car parking: ample free car parking on street

Purchase Costs and 3% Stamp Duty

The purchase costs are negotiated with third parties and fixed at £999 and include solicitor costs, local searches, 12 month’s insurance and land registry fees. The buyer has to pay the 3% stamp duty fee. If you do not own another residential property (anywhere in the world) you can get exemption. The amount of fee on this type of property would be £2,790. Total Cost (£92,999 + £999 purchase costs + £2,790 stamp duty) = £96,788. If you are not resident in the UK, then there is an additional 2% Stamp Duty.

Semi-detached Houses from £99,999

These are our most expensive houses. They have a more modern design and plenty of space at the front and large rear gardens. Although these are the most expensive, they do represent great value and have good capital growth potential.

TYPE H7 2-Bed Semi-detached Houses £109,999

- 2-Bed Type H7 Houses – £109,999

- Net Rent – 7% of price – £7,700 /Yr.

- No Management Fees. No Other Costs

TYPE H8 3-Bed Semi-detached Houses £122,999

- These are larger houses with bigger rooms and 3 bedrooms. £122,999. Net Rent 7% £8,610 /Yr.

- These are our most expensive investment properties and have very good long term potential and represent great value. Prices on specific houses may vary a little depending on value and rent.

More on Investment Properties

Why are these Properties the Best for Investment?

- Here are just some of the reasons why we recommend such properties:

- High rental yield due to rental demand. The rent we pay is a net rent and very competitive

- Low cost and thus affordable without a mortgage

- Good capital growth potential as the economy is now recovering.

- You rent directly to us. We rent to our subtenants

- Net rent system.

- Secure purchase process with defined verifiable stages.

- Low purchase fees that are fixed so you know what your costs will be.

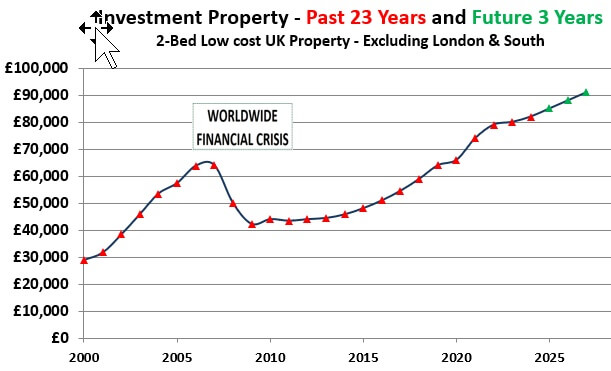

The chart below shows that, on average, properties were selling for £30,000 in the year 2000, after which the prices rose, fell and now are expected to rise again.

Our view is that sub £120,000 properties (away from London) are the best for investment as they not only deliver the best rental yield but are now also expected to grow the most in terms of capital value.

Holiday Use

The best way to use your property is to keep it rented out all of the time and to use the rental income for your holidays and visits to the UK. This is more cost-effective and allows you to have your holiday anywhere in the country, in accommodation of your own choice. Trying to use your property for holidays is not cost-effective and actually ends up costing you more!

Future Own Use

If you relocate or decide to live in the UK, and need a property for your own permanent use, then the best thing to do is to re-sell these investment properties and get an ‘own use’ property in your desired location. We can help you do this. In the mean-time, your funds would have grown at a good rate. Another option it to rent an “own use” property and use the rental income from your investment properties to pay for it.

Buying for Children’s Education

Many clients initially are looking for a property that is near a university so that this can be used by their children if and when they do come to study in the UK. Our advice is that if this is your main aim – then you should NOT purchase property yet. The problem is that the selected property may not be in the right location, in the right community, convenient for your child – even if it is near the town you think your child will study at. It is better for them to rent initially and have the ability to move around to ensure they are in a convenient and safe location for their studies. We have many clients from overseas who wish to do this but practically they never end up using their own properties for one reason or another.

Instead if you do want to get a UK property, it is better for you to get a purely investment property that you leave rented all out of the time. You can then keep the rental income in the UK and use this income to pay for your child’s university accommodation. This will give you and your child more flexibility.

Mortgages or 2-Step Process

We do not do mortgages as our 2-Step Process is betterthan a mortgage as there is NO Interest. Watch the 2-Step Process video on our home page on how you can buy any property in our range in 2 stages with initial payment of just £39,999. It works out much better than a mortgage as there is no interest or mortgage fees.

2-Step Process – Better than a Mortgage

Residency in the UK

The UK is an “open country” for property investment. Any National of any country can buy property in the UK. We are managing over 800 properties for overseas clients. Buying any property in the UK does NOT give any automatic rights to residency, long term visa or citizenship. All of our overseas clients buy such properties for long term secure investment and to give them options in the future. We keep them rented out for them and they keep the rental income in the UK and use this for their holiday accommodation, children’s university fees or other needs. This gives them much more flexibility and works out to be more cost effective. Thus, the investment property can be in a different location and size to their holiday accommodation to deliver the maximum yield and long-term growth potential.

However, buying a property does increase your links with the UK and allows you to have income in the UK and be registered with HMRC tax office (although you may not pay any tax if your income is below £12,500 per person per year). It gives you options for the future and such a purchase may still be worth considering if you have long term plans to spend more time in the UK. If residency is your main aim – then you should not buy a property – but seek appropriate visa or immigration advice.

House are Better than Apartments

Almost all of the new apartment developments (e.g. in city centres) fall into the NEW leasehold category and are not suited to long term investment. The reason for this is that owners do not have true ownership due to the lease being 99 years or 125 years etc and in the new leases the service charges can be increased by the developer after every 10 years. The net result is that these type of properties (whilst looking good on paper) do not appreciate well over the long term. Thus it is better to buy houses rather than apartments

If the apartments are not ready then the risks of off-plan remain. Typically there are too many parties involved. The sales company, the developer, the builder and the management company. Agreements made with the sales company will not be fulfilled by the sales company. The people you buy from are not the people you deal with long term. Thus any promises made will depend on the fine print of any agreements and will only apply to the parties that made the agreements. No one party will take the total responsibility or accountability for the investment and its returns. The guaranteed returns and buy back assurances may be given by other third party companies and not the seller.

The old nominal leases (999 years at £1 per year) and freehold properties such as houses do not have these problems, so you have total ownership and thus houses and are more suited to long term investment.

On average freehold type houses have doubled in value every 8 years for the past 60 years. The only exception was the financial crisis from 2007 to 2012 when prices actually fell on all types of property all over the world.

London

We do not sell properties in or anywhere near London or the South as the prices there are very high and the % rental yields are too low. The same property which we sell for £60,000 here in North East is over £300,000 in the South. In the past London has done very well in capital growth – however this is less likely to be the case going forward and the risks of buying here are now higher. Many clients just RENT near London (if they have to be near London for holidays or work) but they BUY multiple low cost investment properties away from London as this gives higher income now, and better potential for the future with lower risks.

A purchase of a property for £300,000 in London will give net rent of around £9,000 per year (3%). The same fund will acquire over 5 houses in the North East giving net rent of over £18,000 per year.

It is better for investors to buy multiple lower cost properties for the same budget. The reason for this is that such lower cost properties, as well as delivering higher % rental yields and are now also growing better in % values (capital growth). These are also easier to rent out and resell, are more tax efficient, lower risk, and provide more long term flexibility as you can sell some whilst keeping others. We have many clients that have done this. For new clients who are not confident with us yet, we would normally advise you to purchase just ONE low cost property first and go through the process and be confident and happy with everything before buying more.

Other Large Cities

Properties inside the major cities away from the South e.g. Manchester, Liverpool, Birmingham, Leeds, Sheffield and Glasgow tend to be apartments. These are on the new type of short leases 99 years or 150 years and with service charges that can increase every 5 years. In our view these are not good for long term investment.

On the outskirts of Cities you can get terraced houses. However the prices here are 2 to 3 times more than the prices in Lancashire but the rent are not 2 to 3 times higher. Thus the % rental yields are lower and it is not possible for us to provide Net Guaranteed Rent at 6% levels for the long term. In our view the best value is represented by the lower cost houses in Lancashire as these will deliver better rental yields, higher capital % growth and lower risks.

Investments to Avoid

Beware of Student Room Investments

These are single rooms within student flats and sold as leased investment units. The properties are built by builders and developers, marketed and sold by sales companies and managed by different student management companies. The rooms can only be rented out by the management company – you cannot use them or rent them out yourself. They can only be re-sold to another investor who agrees for them to be continued to be used as student-only accommodation.

Whilst there are some projects that offer good value, many do not due to high management/ service costs and short leases (student properties are not freehold). Prices are inflated with a single mini bedroom in a shared flat costing around £50,000 and they cannot be sold to anyone other than an investor. Thus, the market re-sale value may not rise (and can fall). Typically, these are sold by aggressive sales agents who do not have control over the property and no subsequent contact with the buyer. We have had many customers who have contacted us wanting to exit such investments and were prepared to do so even at a loss.

Student rooms are not really comparable with freehold houses and would be impossible to sell without the guarantees made by the companies advertising them. Unfortunately, such guarantee wording is drafted in a way in which there is a ‘get-out’ for the developers, managing companies and sales agents in case the yields and growth are not achieved. This means that it is in fact the investors that carry the risks. We have sold these rooms in the past and they are not the risk-free investments many of these companies claim them to be.

With the student investments, there can be several parties involved – properties are sold by the commission based sales company, they are purchased from the developer or builder, and the student management company who you will be dealing with is completely different. When you purchase a standard house with our help, we are responsible and liable for all aspects of the purchase, rental and management; we remain your contact for the life-time of your investment.

The best student property to buy is a standard house near a College or University. Standard UK houses can be sold to anyone (or used by yourself) and are now increasing in value at good growth rates.

Hotel Rooms, Care Homes, Car Parks & Storage Pod Investments

These fall into a similar category to student pods. The values are inflated, there is no true re-sale market (can only be sold to another investor) and capital growth is not realised.

There are multiple companies and contracts in each transaction and no one company totally accountable to the investor. Whilst returns may be guaranteed for a short period there are hidden charges

‘Under-Construction’, Off-plan apartments or Virtual Property

Take extra care when purchasing an investment property that is yet to be built or is under construction. The risks with such properties remain high. The project could be cancelled, and there can be delays in completion and then in renting the properties out. Prices are often inflated by developers as properties are difficult to compare.

For investment, only consider property that is built and already rented out. Buy from a company that has control over the property and who remains responsible to you after the sale. Again, there are exceptions and some of these properties can be suitable, especially for your own use in cities.

Growth Chart – Low cost investment houses

#image_title

NEXT STEPS

Complete any enquiry from, Get a draft agreement and have a zoom video meeting.