UK Property Market

2024 Outlook

In this short Summary Video Dr. Tariq from Find UK Property explains what we offer but also covers why prices on high end houses have stagnated in 2023, but low cost properties have not fallen, and are set to rise in 2024 & 2025, as investors switch from high cost properties in the South to low cost properties in the North. He also explains why if you have savings, then doing NOTHING is a big risk due to high inflation. The real value of £100,000 could fall to just £80,000 in 2 years. The video covers how a low cost property can protect savings providing long-term growth and giving guaranteed income. He also explains how we help clients easily purchase the property and manage it – so that they can be true passive investors.

Property Market Topics

This rest of this page outlines the reasons why small low cost houses in the North are the best properties for long term investment. It also explains why Find UK business model and service is competitive and delivers the best overall value for property buyers. It is divided into 7 main sections:-

1.UK Property Price Trends

This section explains why property prices are rising and the expected trends for the short-term and long-term. There have been no effects of Weak Pound, Inflation, War, Post-Brexit and Post-Covid issues on prices – but high interest rates have reduced demand for high cost properties, especially in Londn and the South.

2.Best Areas and Types of Properties for Investment

This section explains the best areas and types of properties for investment and the reasons why.

3.Market Pricing and Comparison with Sales Agents

This section compares pricing for such houses in the market and the prices and services offered by other sales estate agents compared with Find UK Property. Whilst you may see a property in the open market at a lower price, when you factor for everything that is included in our package and compare like for like, you will find that our package price is the lowest cost overall.

4.Tenants, Rental Demand and Comparison with Letting Agents

This section explains the rental demand outside of London and compares the likely net rental return over the next 10 years. It explains how net rent returns are dependent heavily on the quality of the letting agent and services provided.

5.Capital Growth, Investment Returns and Other Benefits

This covers historical property growth in the UK and summarizes the likely overall investment return and benefits over the next 10 years for investors using our service compared with other agents.

6.How do Property Agents and Find UK make a Profit?

Explanation of how our company makes a profit

7.Growth Chart and comparison with South and London

This section shows growth trend of low cost property and explains why the South and London are no longer the best areas for property investment in the UK.

1.UK Property Price Trends

General Price Trend

The underlying long-term trend for houses in the UK is that they double in price every 10 to 12 years. This has been the average historical trend for the last 70 years. The reason for this is that demand has remained higher than supply.

House building is, in general, not permitted on green land in the UK. It can only be built on existing ‘brown-field’ sites which are very limited. The number of potential households increase as the population increases and as fewer people live in each household. The desire for people to own property in the UK is strong and this continues to drive the price upwards over the long-term – this is despite the short-term falls in property values during periods of recession (in the 1980’s and from 2008 to 2010).

This general trend is likely to continue for ‘low cost’ property for the next 10 years despite short-term effects of a recession relating to War, Energy Crisis, Inflation, Weak £ , High Interest Rates, Post-Covid or Post-Brexit effects. Long-term growth, however, may be lower for ‘high cost’ property as shown below. Thus no matter what happens in the market the overall long term trend for property is positive. If your investment is for long-term then you need not worry.

Post-Covid Effects

Covid 19 resulted in a significant recession as the economy was impacted worldwide. However, during a recession, renters and buyers try to cut costs. Rental demand at the lower end of the market increases, whereas, it falls at the high end. The same applies to property buyers.

Post-Brexit Effects

Brexit has had no effect on UK property growth despite fears that it would impact it negatively.

War & Energy Crisis

Energy crisis in Europe is linked to the Ukraine War and poor operation of energy markets in Europe. However, homes that are Energy Efficient will have higher value. Our commitment to all of our owners and tenants is that we will keep all of the properties fully compliant at our cost. This will mean an energy rating of Grade C or higher

Inflation and Cost of Living

Demand at lower end of market from both renters and buyers is increasing as people try to cut costs. Like Energy, housing is a necessity and when demand increases, the prices increase. For investors, who have money sitting in banks, their money is depreciating due to high inflation. Property always grows faster than inflation over the long-term. So high inflation means more investors will buy property.

Weak Pound £

Weak pound means that Expats and overseas investors can buy UK property up to 20% cheaper than last year.

High Interest Rates

UK Interest Rates have increased. High interest rates makes mortgages unaffordable. Properties that require mortgages (e.g. over £200,000 and higher) have seen price falls as demand falls. Most such properties are in the South and London Properties that are affordable with out mortgages e.g. £65,000 to £85,000 will see price increases as these are NOT affected by high interest rates. Most of these properties are in the North. 99% of the properties we sell are CASH purchase as we focus on lower cost houses.

Low Cost Property – Forecast

Prices will continue to rise both in the short-term and long-term due to 5 Reasons shown below. These will ensure that demand for low cost property remains higher than supply.

a.General trend

As stated above, the underlying trend whereby property prices double on average every 10 years, over the long term, is likely to continue to apply to low cost properties. Population growth and limited property stocks in the UK will result in continue long term property value growth.

b.Shift from ‘high cost’ to affordable ‘low cost’ Property

During a recession or negative sentiment relating to economy (due to the factors above), there is cost cutting by consumers. This results in increased demand for property that has lower rent or is lower priced. Prices at the high end do not grow and may fall, whereas prices at low end will rise due to increased demand.

c.Shift from major cities to smaller towns

Many people with office type jobs have discovered that it is possible to work remotely. Many businesses are finding that in some cases remote working of employees from home is actually cheaper for the business. This trend will continue and demand for properties in smaller towns (where we sell houses) will increase. More expensive properties and apartments in major city centres may not increase and may actually fall in price especially during any recession.

d.Increasing Demand from Investors

Rental demand remains strong and investors are increasingly switching from shares, bonds, savings and other ‘paper investments’ to real property which provides more security.

e.Shift in property investment from the South to the North

Buyer are finding that prices near London and the South are very high. Investors are learning that lower cost properties in the North deliver better investment returns. Thus, there is shift in property buying with more buyers considering the North and this trend is likely to increase.

High Cost Property – Forecast

Prices have fallen in the short-term during 2023, especially in London and the rest of the South of the UK due to high interest rates. However, over the long-term the prices will continue to rise but the growth on ‘high cost’ property may be less than double over the next 12 years.

2.Best Areas and Types of Properties for Investment

In the UK the best properties for investment are the smaller, lower cost properties. The reason is that these properties are in high demand for rental and thus deliver the best rental yields. Unlike other countries, in the UK small house are more popular than apartments and if well managed, deliver better net rental returns. Here are some Key Point:-

-There are only TWO areas in the whole of the UK where prices on full houses are still low (below £70,000) yet growing well, and rental yields approach 8%. These are East Lancashire in the North West and the wider North East area.

-In the past The North has been depressed with high unemployment but now – over the past 15 years there has been very good recovery (unemployment has fallen from over 15% to 5% in some areas). UK economy has moved from manufacturing to services and online, and many large companies have opened their call centres and logistics/service centres along the Northern motorways due to lower property costs and salaries. Overall the North, especially the North East is expected to do very well.

-The % capital growth on property here is expected to be better than the South over the next 10 years. On average terraced houses like this double in value every 10 to 12 years.

-Rental demand is at the lower end of the market but is strong with a ‘culture’ of rental rather than buying. Around 40% of people rent and the preference is for houses and not apartments.

-Due to general population and family growth in this area, demand for houses has increased and whilst there was plenty of supply in the past, now there are shortages. Recently many developers have started to build new houses on brown field sites and prices on older houses are also increasing.

-The best yields are still provided by old lower cost terraced houses which still make up about 60% of the housing market in these areas. Over the past 15 years, we have identified 28 good neighbourhoods in the North and we try to acquire all new houses in these ‘tried and tested areas’.

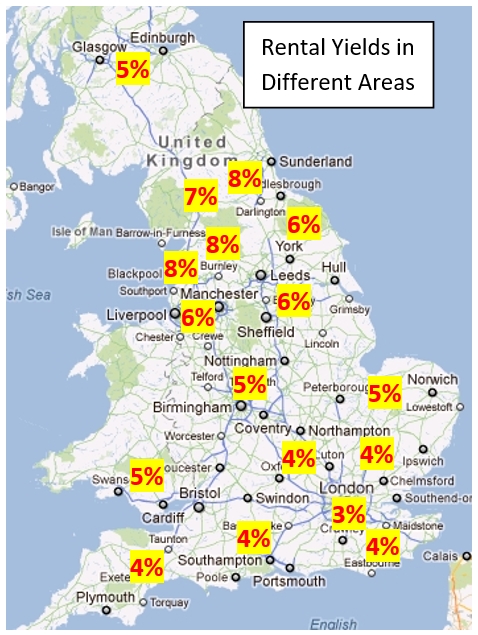

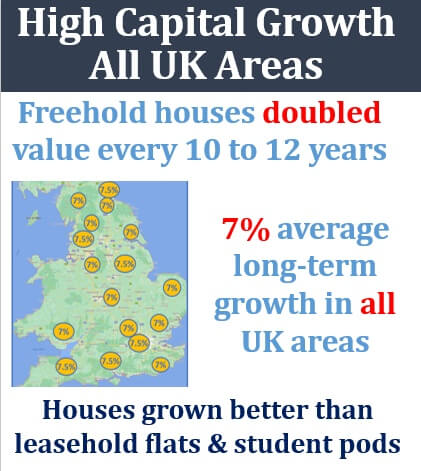

-Investment return on property comes from both Capital Growth and Gross Rental Yield. Capital Growth in value in different areas of the UK is surprisingly very similar in % terms over the very long term e.g. 50 years – on average. However, there are variations in the medium to short term (London did very well in the past 15 years but the North is expected to do better in the next 15 years). Overall, on average, UK houses have doubled in capital value every 10 to 12 years for the past 100 years. Gross Rental Yield is the annual rent divided by the value of the property expressed as a percentage. Example – If you buy a property for £100,000 and get £8,000 rent per year. Then the gross rental yield is 8%. The map below shows the gross rental yields % on houses in different areas of the UK. Gross Rental Yield varies greatly depending on rental demand and property pricing in each area. You can see that the North West and North East of England deliver the best rental yields as property prices are still very low and the rental demand is strong.

3.Market Pricing and Comparison with Sales Agents

3.Market Pricing and Comparison with Sales Agents

Find UK Property work “differently” to normal Estate Agents and Letting Agents. In our system the owner rents the properyt directly to Find UK Property without using any letting or management agents. Our rental agreement means that the owner retain full management control of thier property at all times. We in return take care of everything and agree to keeep the property in a good rentable condition. We pay a fair Net Rent and agree to pay for all costs relating to the property. We sublet to our own tenants and try to get more rent than we have to pay yu – so that we can cover ourcosts. and make a profit. This is a more efficient model and delivers overall better value and lower costs for our clients.

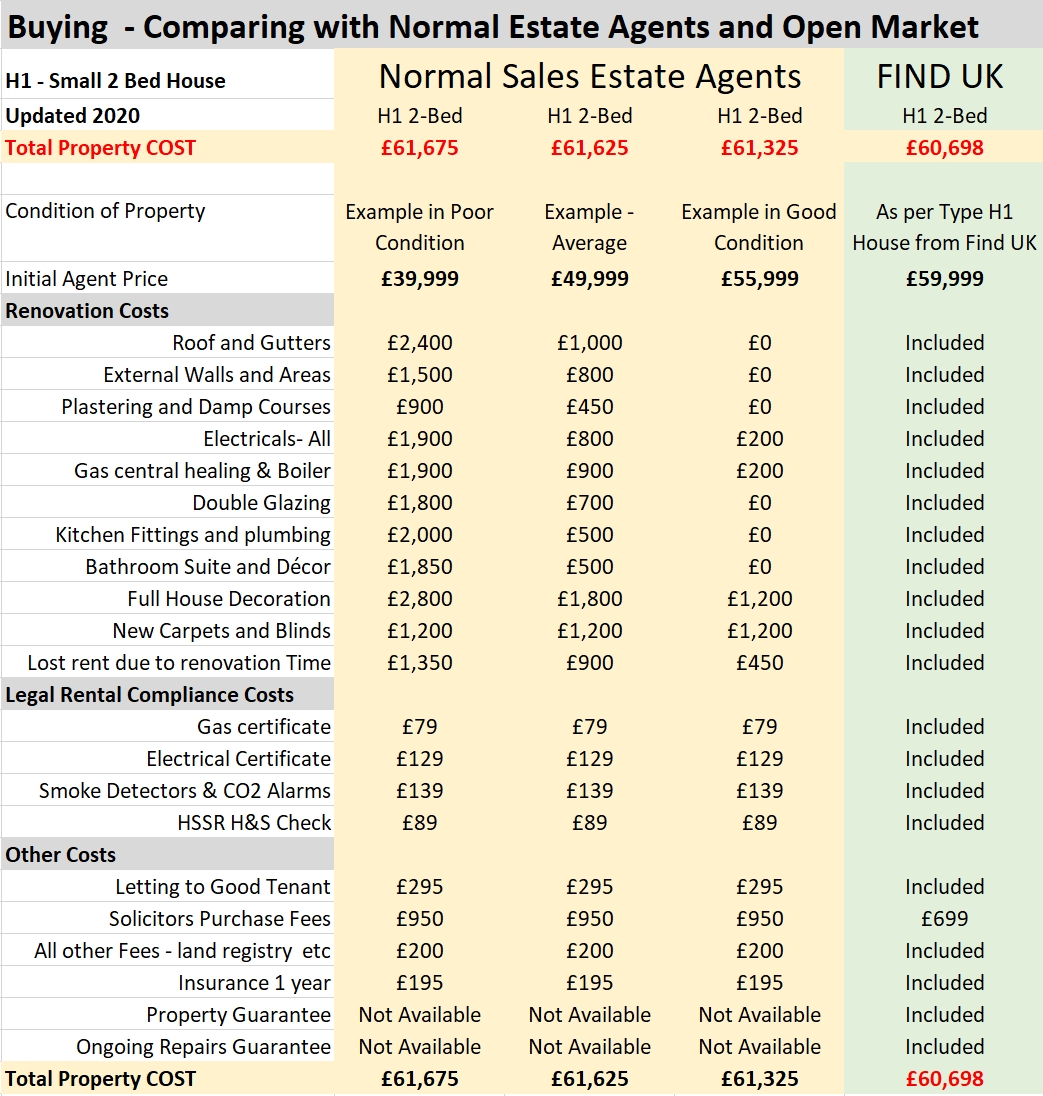

Our clients get better value when they buy their properties from us. The chart below from 2020 compares our lowest cost Type H1 property previously costing £59,999 in the North East (now price is higher at £69,999 and the figures below will be proportionally higher). It is fully renovated and rented out to a good tenants, with buying property in the open market from other agents and sellers. Although the figures are 3 years old, the principle is the same.

All properties in the open market will need some degree of work before they can be rented out. Low cost houses that are in poor condition (e.g. priced around £45,000) often need a lot more work (although they are the cheapest), and, can end up being more expensive as can be seen in the chart. Although there can be benefits in renovating a run-down expensive luxury property, the cost benefits of doing this with low-end properties for normal owners are low and can be negative (because labour costs are a big percentage of the property value). So, it is better to buy such properties fully renovated with guarantees.

We and our partner group of companies buy the properties first. Then we renovate them fully at our own costs to a good standard and categorise them according to their value and investment potential. Within each category the houses are very similar. We ensure all houses are compliant with all the legal rental requirements and then we rent them out to good tenants who will live in the properties for a long time and look after them.

Due to our buying power and use of our own staff to renovate and rent out, we can make overall savings. This means that we can make a profit whilst still delivering great value for money to the property owners. See the examples below in the chart.

Whilst you may see a property in the open market at a lower price, but such properties are not recently renovated or guaranteed,. You need to factor for everything that is included in our package and compare like for like. When you do this, you will find out as per the examples shown that our total package price is lower. Also note that when you buy from the “open market”, you do not get guarantees with the property or ongoing repair guarantees. When you buy from us you do get these. If you use contractors for the renovation yourself then they may charge you even more than the prices shown in the table and you will need to monitor the work yourself to ensure it meets the standards.

In example one, a property purchased in poor condition for a very low price such as £39,999 from the open market will need a lot of money to be spent on it before it can be rented out. You will need to renovate it fully, make it legally compliant and then rent out to a good long term tenant. The total costs of doing this would be a lot more than our price (that includes everything). Although the figures are 2 years old, the principle is the same.

4.Tenants, Rental Demand and Comparison with Letting Agents

4.Tenants, Rental Demand and Comparison with Letting Agents

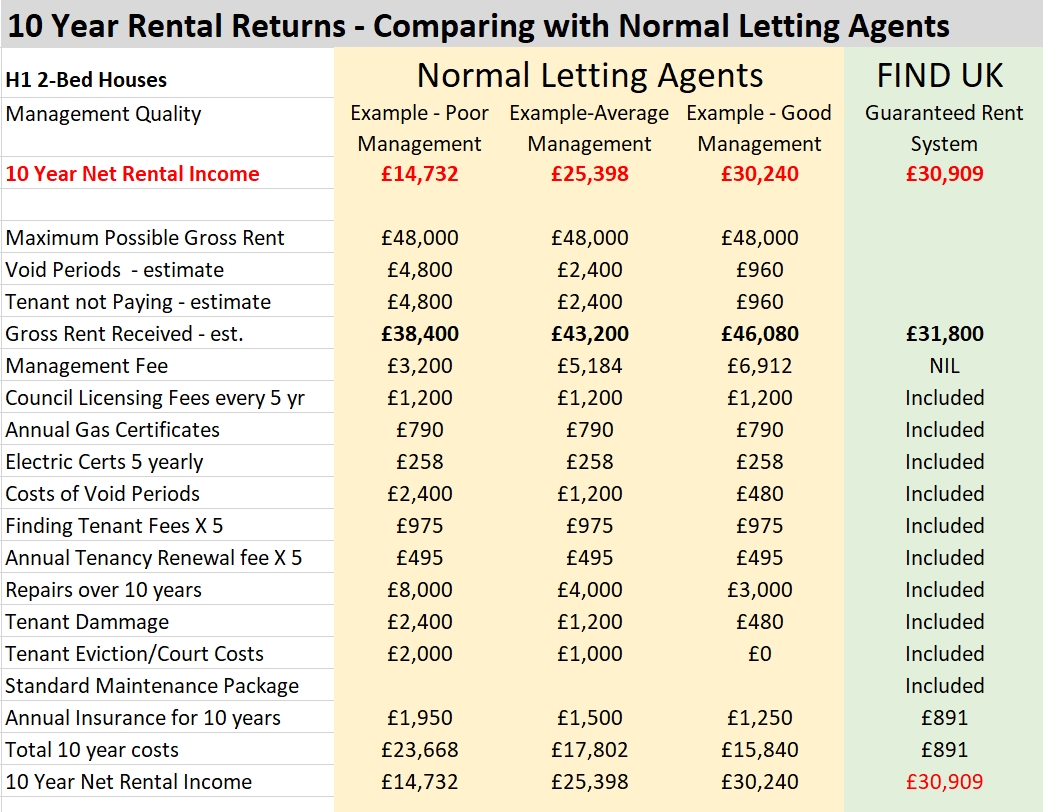

Rental demand in the North is strong but is at the lower end of the market. Such tenants need to be supported and managed well. Our clients do not use management agents. They retain the management control and simply rent thier properyt directly to us. We become your tenants and we sublet the property to our own subtenants. The subtenants are not your concern but you have full control as you can cancel the tenancy agreement with us with the required notice period. We can move our tenant to another property and had the property to you. The chart below compares 10 Years of renting directly to Find UK Property and using Standard Letting or Managing Agents. We have shown 3 types of Letting agents with various standards of management (Poor, Average and Good). This chart assumes rents remain static for all (although we would expect it to grow).

In example 1, using a poor letting agent could mean that property is vacant for long periods or is let out to a bad tenant that damages the property or does not pay the rent. Furthermore, there may be poor maintenance of the property and ongoing repairs costs could be very high. The related costs would reduce your net rental income significantly. In our system, our rental agreement means that we carry all the costs for these. We actively minimise these issues that could increase costs as we have to pay for them.

The way we work to manage and look after these properties ensures that overall costs are kept low as we do everything ourselves and treat these properties like our own. Because we renovate properties well up-front, the cost of maintenance and repairs to us is low, but the value to our clients is very high. This means that we can make a profit whilst still delivering great value to our customers. The chart above compares our pricing, product and service with normal letting agents. Overall, our clients get better rental income and greater peace of mind by renting directly to us. Although the figures are 3 years old, the principle is the same.

5.Capital Growth, Investment Returns and Other Benefits

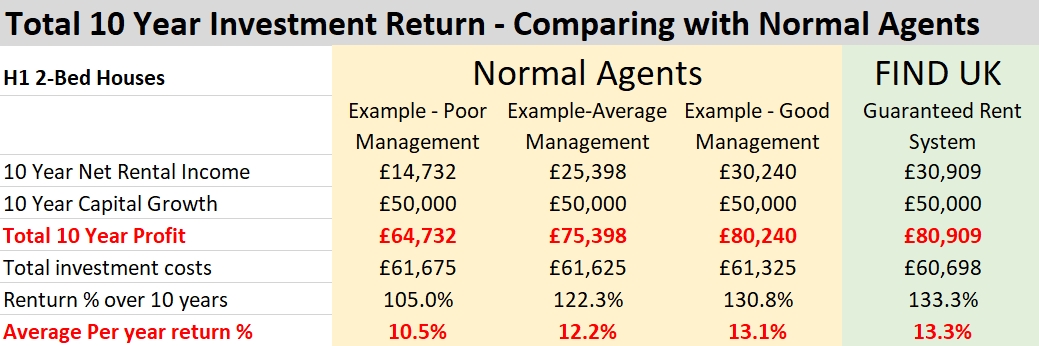

Capital growth is hard to forecast but on average these types of houses have doubled in value every 12 years over the past 70 years. The only exception was 2007-2012 when they fell in price following the worldwide financial crisis. In the example below, we have assumed all houses would double in value over 10 to 12 years and give a capital return of £50,000. This is reasonable and not excessive. Capital growth is not guaranteed and may be lower or higher.

The total investment return plus rental income return is also shown. You can see that overall, low-cost property gives good annual returns on investment. It is more secure and gives better returns than anything else you can invest in. Even with poor management you still get good returns of over 10% annually. Find UK and Good Management with any other good letting agent are expected to deliver returns of over 13% annually on such houses in the long term. Although the figures are 3 years old, the principle is the same.

Our clients find that there are other benefits with Find UK that are difficult to cost and price up. We have listed some of these here in this section.

Net Rent gives reliable income

Clients normally remain under our Net Rent system – even after the minimum 3 years, as the commercial tenacy agreement where you let you properyt to us can be renwed each year autmatically after the minimum 3 year term. Thus, clients continue to benefit from certainty of income and can plan their life confidently. Our rent is “effectively” guaranteed because of the direct rental agreement betwen you as Landlord and us as the Tenant. If we do not pay the rent as agreed we would be in breach of that agreement. This has never happened in the last 15 years since we have been trading.

No Landlord Liabilities

We have an agreement with you to rent the property from you for the long term. Thus you only have ONE tenant – that is us. Thus your landlord liabilities are simple and as per our agreement. You are NOT responsibe for our subtenants. You rent your properyt directly to us and retain management control. We sublet to our tenants and become the Landlord to our tenants. This means that we can deal with all issues relating to the responsibilities of the Landlord. Normal letting and management agents do not do this, and you will still need to be involved if there are any legal issues with the property, tenant or authorities. With our service, we take care of everything – so you do not need to worry about any of this. You can get on with your work or your retirement – in peace.

No Hassle from Agents, Tenants or Authorities

A normal letting agent would need to contact the owner constantly if there are issues with repairs, maintenance, rent or damage by the tenant etc. We do not do this as our agreement means that you rent the property directly to us. – we just fix the problems like it was our own property at no cost to you. You will not need to field any calls from the local authorities or other bodies – everything is dealt by us as per our agreement with you.

Overall Peace of Mind

We are a good tenant and will deliver on our agreement. Our package gives overall peace of mind. This is difficult to price. For a lot of our existing clients this is priceless.

6. How do Property Agents and Find UK make a Profit?

The trading model used by standard property agents and management companies is based on increasing the costs to the owner – as their profits are partly linked with this. They make more money with increased maintenance costs and property re-lets. Our model is based on renting the properyt from you and then treating these properties “like our own” and minimising the costs to us. We achieve this by ensuring our subtenants are supported well and stay in our properties for the long term.

Our clients who become our landlords when they rent the properyt to us, really like our service and for many it is well suited to their long-term needs. Over 70% of our business every month comes from existing clients or from their relatives, friends or contacts. Often they ask us “How do you do this? How do you deliver such great service and still make a profit?”

There are 3 ways in which we can make profit

- Renovation Margin

We buy well and at a lower price than the market – many of our properties are purchased direct from sellers, before they go to an Estate Agent. We regularly door-drop leaflets in every house in 28 “tried and tested” key areas of the North encouraging sellers to sell directly to us quickly and for immediate cash payment. This saves the seller on agent costs, allows them to sell quickly and means we can buy cheaper. Then we renovate properties fully ourselves, make sure they are complaint, and then rent them out. Due to our buying power and use of our own staff to renovate and rent out, we can make overall savings. This means that we can make a profit whilst still delivering great value for money to our clients.

- We pay you a good fair rent but we get more from our sub-tenants

If we do our job well in getting good tenants and keeping the properties rented out all the time, we can achieve higher rents from our sub-tenents than the net rent we have to pay you. Thus, we can make a profit and cover our costs.

- Keeping Costs Low

We keep our costs low so that overall business can be profitable. We are efficient and save on costs in 5 areas:

- We do not have to spend time and administration costs in constant liaison with owners as we can take all decisions regarding tenant and property maintenance ourselves as we are the landlord to our subtenants.

- We do not need to do unnecessary repairs – just repairs to keep property in a good condition. Other letting agents make a commission on the repairs they do on your behalf – so it is in their interest to increase the repairs costs – even doing repairs that are not needed. It is in our interest to keep these costs to a minimum. We do this job well ensuring the property is well maintained, always rented out and fully compliant.

- We pay you rent quarterly – again to reduce admin costs and bank transfer fees

- We have qualified electricians, gas safety staff and HHSRS qualified inspection staff. So, we can do all of these compliance items ourselves rather than using external contractors at extra cost.

- Most of our business comes from referrals and repeat business. Thus we have very low marketing costs. We only do a little bit of internet marketing – that is all.

7.Property Growth Trend

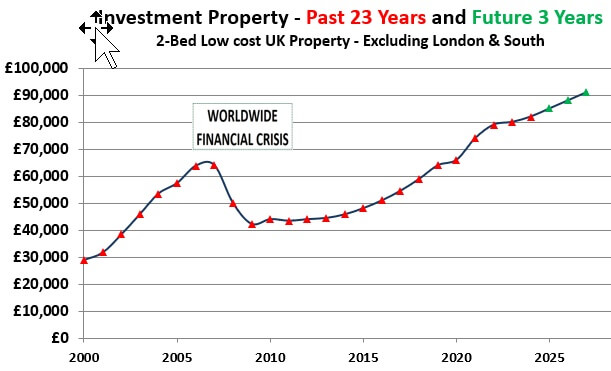

Prices for such low cost properties – fell sharply from 2007 to 2009 following the financial crisis. Prices have been stagnant but stable over past 4 years (partly due to uncertainties of Brexit) but are now rising. The rate of increase is now increasing due to the economic recovery in the North. Some forecasts suggest a rapid catch-up rise followed by more steady growth over next 6 years.

#image_title

The chart below shows the average price of properties that were selling for £30,000 in year 2000. You can see that prices rose until 2008 and then fell sharply. Prices also stagnated in first year of Covid but then rose sharply and slowed down with high interest rates from August 2022. Now the low cost houses are risign again as switch in demand from South.

Thus our view is that sub £120,000 properties (away from London) are the best for investment as they not only deliver the best rental but are now also expected to grow the most in terms of capital value.

Capital Growth in different areas

Many people think that capital growth is higher in London and the South and higher for high cost properties. This is NOT True. The % Percentage capital growth is actually the same over the long-term. All houses in the UK have on average doubled in value every 12 years in the past 70 years – no matter where located or at what price points.

#image_title

Comparison of London and the South with North

- Northern properties are less than 25% of the price of West London and Southern Towns for similar type and size of property.

- Gross Rental yields are almost double in the North as property values are low. Demand for rental property is high.

- Gross Rental yields decrease as property price increases and this trend applies to ALL areas. The smallest properties are the best for investment.

- Terraced and smaller properties are lower cost and give better rental returns than large detached houses, which are popular for own use.

- Capital Growth nationwide is very similar in % terms. Overall, over the long-term all houses have grown at similar average rate of over 7% per year